Hedera Hashgraph exploded final evening after pretend Blackrock RWA deal ripped by means of chart – as value crashes discover out what’s subsequent for Hedera in HBAR value evaluation.

HBAR, the native token of the Hedera blockchain, soared yesterday after social media customers wrongly thought BlackRock, one of many world’s largest asset managers, had tokenized its ICS U.S. Treasury Cash Market Fund (MMF) on Hedera.

Archax Tokenizes BlackRock Cash Market Fund on Hedera

In a tweet, Hedera clarified that Archax, a digital asset buying and selling platform within the U.Ok., partnered with Ownera–an institutional-grade blockchain for digital belongings– to tokenize BlackRock‘s MMF shares.

By tokenizing them, MMF shares may be traded sooner and extra securely on the Archax platform and linked networks.

With this affirmation, it’s clear that Archax, not BlackRock, had chosen to tokenize on Hedera.

Graham Rodford additionally mentioned they selected to tokenize these shares on Hedera, given their registration by the U.Ok. FCA.

Even so, it could have been a large enhance if BlackRock had made this choice, it could have urged that the asset supervisor discovered worth in Hedera after first launching BUIDL on Ethereum in Q1 2024.

There could possibly be a number of explanation why Archax determined to decide on Hedera over Ethereum. Although Ethereum is widespread, Hedera presents higher settlement speeds and is extra cost-efficient. It’s also safe since there are validators from all around the globe.

Nonetheless, BlackRock shares aren’t the one choices on HBAR.

Final 12 months, Archax helped abrdn plc, a wealth supervisor, tokenize its Aberdeen Customary Liquidity Fund (Lux) – Sterling Fund MMF on Hedera.

HBAR Value Evaluation: BlackRock Information Fuels Surge and Correction

Following this announcement, HBAR costs soared by over +80% on Tuesday earlier than extending features within the early Asia session on Wednesday, registering new 2024 highs of $0.18.

(HBARUSDT)

Nonetheless, at press time, the token has since corrected, sinking to $0.12 for a -30% retracement.

Regardless of the dip, HBAR continues to be up by over +90% from April lows – highlighting market urge for food for the Hedera Hashgraph token.

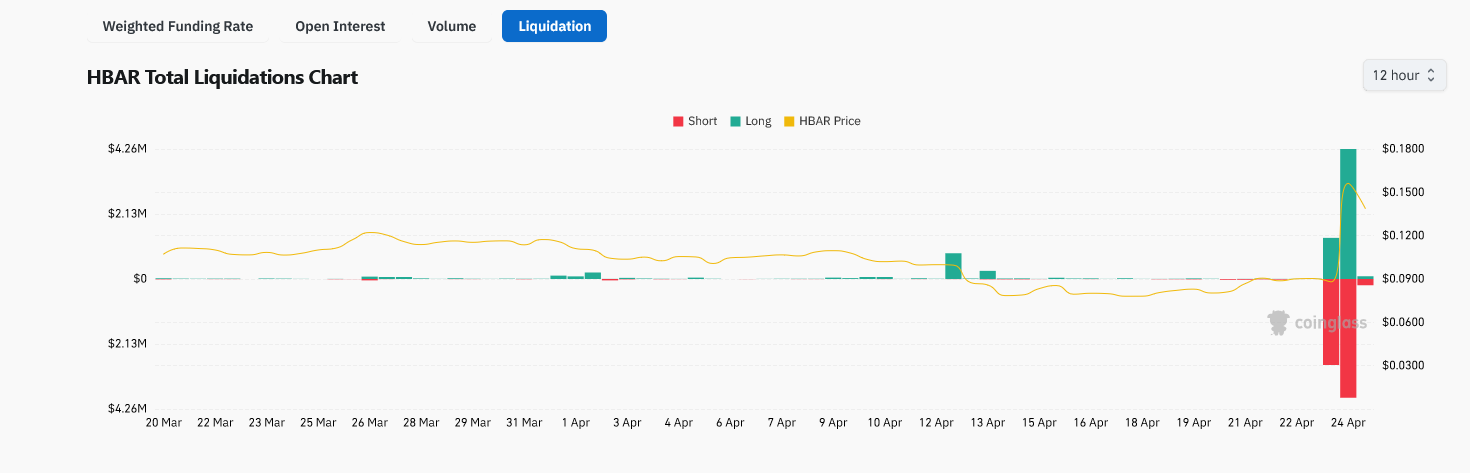

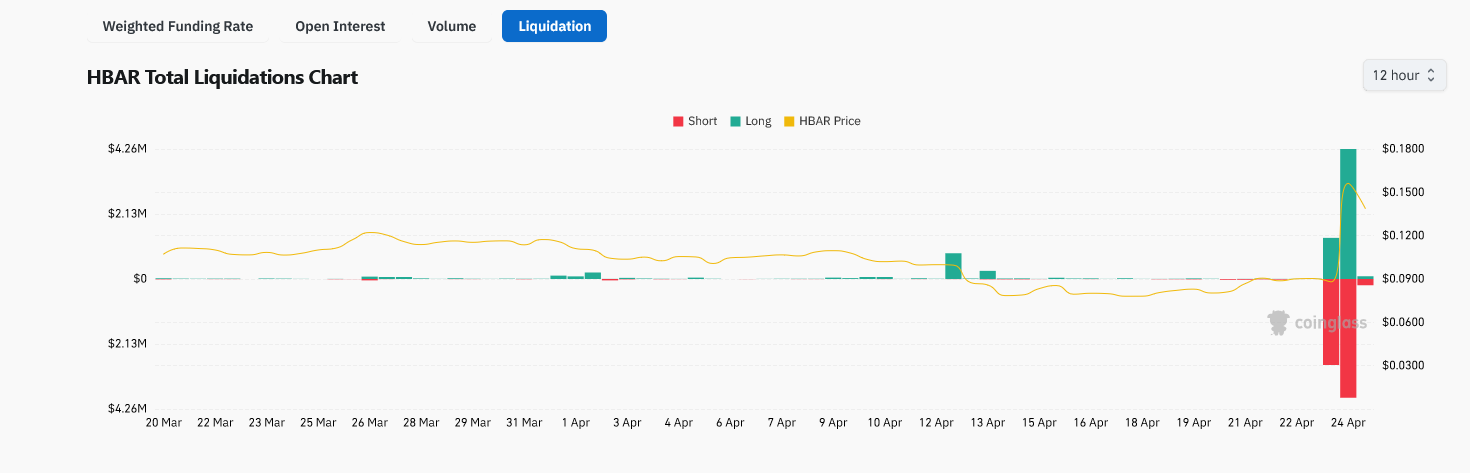

With HBAR costs unstable, CoinGlass data confirmed that over $3.8 million shorts have been liquidated, and over $4.2 million leveraged longs have been forcefully closed within the final 12 hours.

Discover: Stacks (STX) Unveils Roll-Out of Nakamoto Layer 2 Improve

Disclaimer: Crypto is a high-risk asset class. This text is supplied for informational functions and doesn’t represent funding recommendation. You would lose your entire capital.