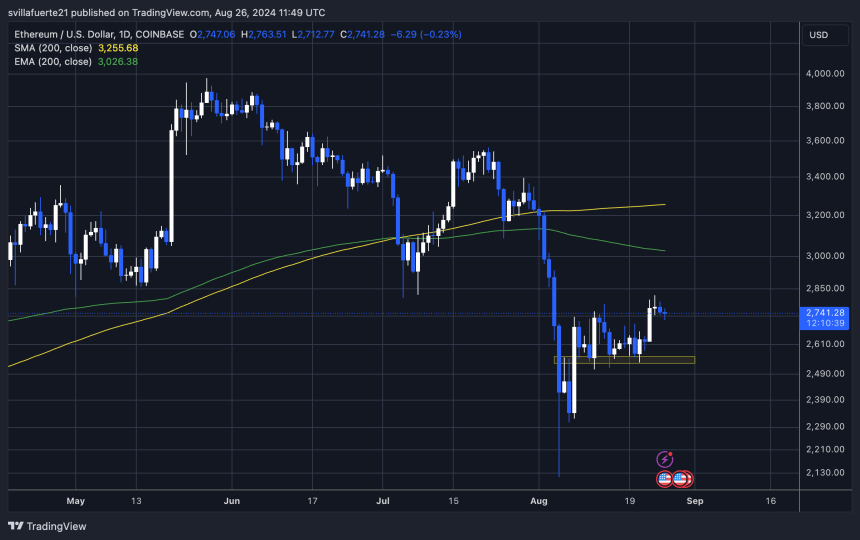

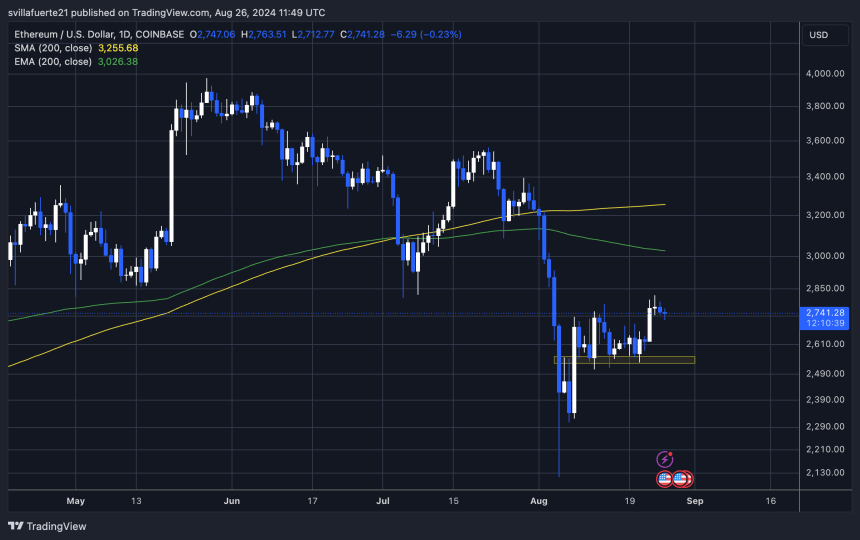

Ethereum is in a basic accumulation section following its current correction and is now concentrating on a $3,000 value. After dropping to $2,116 simply 20 days in the past, ETH skilled a major value surge, recovering to increased ranges, suggesting bullish momentum was constructing.

Associated Studying

This accumulation section has drawn the eye of analysts and traders alike, who at the moment are carefully monitoring Ethereum’s value motion for indicators of a extra important transfer to the upside. The restoration from current lows has sparked renewed optimism, with some market specialists predicting that ETH may attain $3,000 within the coming days.

This potential rally is a essential milestone in Ethereum’s ongoing market cycle, reflecting its power and traders’ confidence in its long-term worth. As Ethereum continues to build up and consolidate, the market is bracing for what could possibly be a significant breakout, setting the stage for brand new highs shortly.

Ethereum Value Construction Suggests A Coming Breakout

After a comparatively lengthy interval of consolidation, Ethereum seems poised for a transfer towards increased costs.

Analyst and dealer Castillo Dealer shared a technical analysis on X, highlighting a possible ETH trajectory shift. In response to Castillo, ETH will possible retest decrease demand at $2,611 earlier than concentrating on the numerous $3,000 mark. The 4-hour chart means that this era of consolidation has reached a tipping level, an necessary transfer could possibly be imminent.

The $3,000 degree isn’t just a psychological barrier; it has additionally acted as a help in current months earlier than breaking down in the beginning of this month, making it a vital resistance to interrupt. If Ethereum efficiently breaks above this degree and consolidates, it may pave the way in which for a sustained uptrend.

Associated Studying

This anticipated breakout may start a brand new bullish section for Ethereum because the market appears to be like to maneuver previous the current interval of stagnation and push towards new highs. Traders and merchants are carefully watching these developments, as the following few days could possibly be essential in figuring out Ethereum’s course.

ETH Technical Evaluation

Ethereum is buying and selling at $2,743; its subsequent transfer may go both approach. ETH would possibly retest decrease demand round $2,500 earlier than making an attempt to push towards the $3,000 mark. This retest would enable the market to determine a stronger basis for a sustained uptrend. Nevertheless, given current volatility, there’s additionally an opportunity that Ethereum may bypass the retest and push to $3,000.

Volatility has proven that something can occur, and the fast value actions are a testomony to this unpredictability. A vital technical degree to look at is the every day 200 exponential transferring common (EMA), presently at $3,026. This EMA acts as a resistance level, and breaking above it could strongly point out a bullish continuation for Ethereum.

Associated Studying

It will affirm power if Ethereum breaks via the $3,000 psychological degree and closes above the 200 EMA. This could solidify the bullish sentiment amongst merchants and traders, positioning Ethereum for a extra prolonged rally.

Featured picture created with Dall-E, chart from Tradingview.com