The derivatives marketplace for Bitcoin (BTC) and Ethereum (ETH) skilled vital fluctuations following the incident on Jan. 9, the place the U.S. Securities and Alternate Fee’s (SEC) Twitter account was compromised. This false announcement of a spot Bitcoin ETF approval led to a sequence of market reactions that worn out over $50 billion in Bitcoin’s market capitalization.

The derivatives market noticed unprecedented volatility. CryptoSlate’s evaluation of CoinGlass information confirmed a rise in total buying and selling quantity by 8.52% to $79.02 billion. This rise in buying and selling exercise possible displays the market’s fast response to the faux information, as merchants both sought to capitalize on the volatility or mitigate their dangers.

Nonetheless, this was contrasted by a 2.78% lower in open curiosity, bringing it all the way down to $19.69 billion. The lower in open curiosity, representing the whole variety of excellent by-product contracts, means that many merchants had been closing their positions amid the uncertainty, preferring to scale back publicity reasonably than interact in a extremely unstable market.

Whereas Bitcoin choices quantity noticed a substantial drop of 39.73% to $625.97 million, the choices open curiosity barely elevated by 2.18% to $10.24 billion. This means that whereas there was a discount within the buying and selling of choices contracts, quite a lot of merchants held onto their positions. This may very well be on account of a technique to attend out the market’s fluctuations or a perception in longer-term developments unaffected by short-term volatility.

The market witnessed $95.41 million in liquidations, with lengthy positions accounting for $59.39 million and shorts for $36.02 million. The upper liquidation of lengthy positions suggests a bearish market response, the place merchants betting on a value improve had been caught off-guard by the drop in costs following the clarification of the ETF information.

Wanting into Binance and Bybit, the 2 largest exchanges by open curiosity, we see each platforms experiencing a rise in buying and selling quantity, indicating heightened exercise. The lower in open curiosity on these platforms additional corroborates the pattern of merchants selecting to shut positions in a unstable surroundings.

| Image | Value | Value (24h%) | Quantity (24h) | Quantity (24h%) | Market Cap | Open Curiosity | Open Curiosity (24h%) | Liquidation (24h) |

|---|---|---|---|---|---|---|---|---|

| BTC | $44911.2 | -4.01% | $77.66B | +5.23% | $884.97B | $19.66B | -3.59% | $94.36M |

| ETH | $2375.65 | +4.47% | $41.18B | +77.57% | $285.82B | $7.78B | +10.67% | $49.30M |

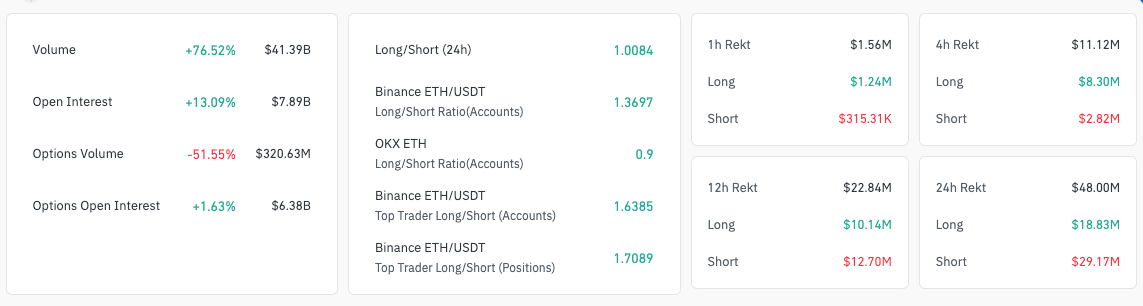

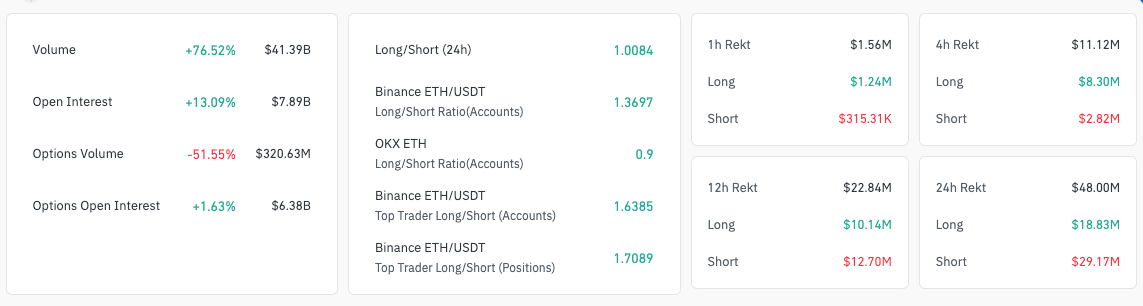

Turning to the Ethereum derivatives market, the state of affairs presents a distinct image. The overall buying and selling quantity for Ethereum derivatives surged dramatically by 79.85% to $41.30 billion. This substantial improve in quantity may very well be attributed to merchants pivoting in direction of Ethereum amid the Bitcoin turbulence or perceiving Ethereum as a safer or extra profitable possibility throughout this era of heightened market sensitivity.

Apparently, regardless of this surge in total buying and selling quantity, the choices quantity for Ethereum derivatives decreased considerably by 51.55% to $320.63 million. This disparity means that whereas there was a normal improve in buying and selling exercise, the choices market noticed a withdrawal.

Merchants may need been extra inclined to interact in futures contracts, viewing these as extra direct methods to capitalize on or hedge in opposition to the market volatility reasonably than coping with the complexities of choices buying and selling in such unsure situations.

Open curiosity in Ethereum additionally elevated by 11.52% to $7.81 billion, contrasting with the sample noticed in Bitcoin. This means new positions being opened, which, mixed with the rise in buying and selling quantity, suggests a extra bullish sentiment within the Ethereum market, or at the very least a notion of Ethereum as a extra secure asset within the face of market shocks.

The submit Ethereum takes the lead over Bitcoin in derivatives buying and selling quantity appeared first on CryptoSlate.