On this Injective (INJ) value prediction 2024, 2025-2030, we are going to analyze the worth patterns of INJ through the use of correct trader-friendly technical evaluation indicators and predict the longer term motion of the cryptocurrency.

Injective (INJ) Present Market Standing

What’s Injective (INJ)

Injective Protocol (INJ) is a decentralized trade (DEX) that gives cross-chain margin buying and selling, derivatives, and forex futures buying and selling. The Injective Protocol is a Layer 2 software developed on the Cosmos blockchain. The protocol makes use of cross-chain bridges to permit merchants to entry cryptocurrencies from platforms corresponding to and .

Injective Protocol, not like different distinguished decentralized exchanges like or Bancor, doesn’t use an automatic market maker (AMM) algorithm to take care of liquidity. As a substitute, Injective makes use of the order e-book idea, which has been extensively adopted by centralized inventory and cryptocurrency exchanges for a few years. On this method, Injective hopes to mix the effectivity of conventional banking with the transparency of decentralized exchanges.

Injective Change merchants solely pay common market maker and taker charges utilizing INJ cash, slightly than community fuel charges for every transaction. INJ cash additionally act because the platform’s governance token and staking mechanism, enabling Injective’s Proof of Stake-based blockchain to operate.

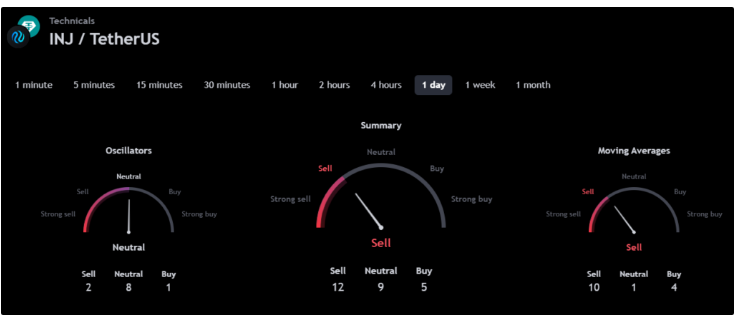

Injective 24H Technicals

Injective (INJ) Value Prediction 2024

Injective (INJ) ranks twenty eighth on CoinMarketCap by way of its market capitalization. The overview of the Injective value prediction for 2024 is defined beneath with a each day time-frame.

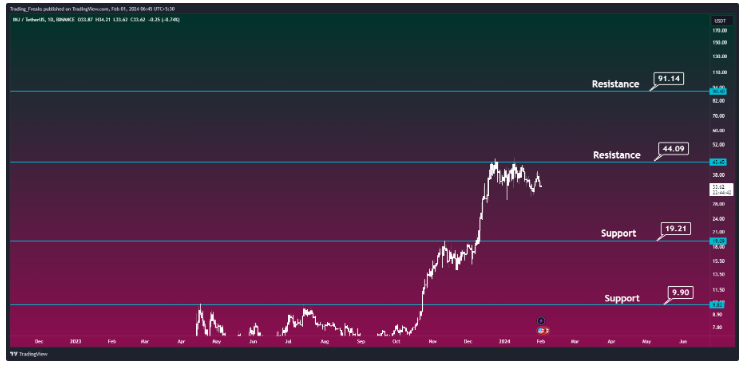

Within the above chart, Injective (INJ) laid out a Horizontal Channel often known as the sideways development. On the whole, the horizontal channel is shaped in the course of the value consolidation. On this sample, the higher trendline, the road which connects the highs, and the decrease trendline, line which connects the lows, run horizontally parallel and the worth motion is contained inside it.

A horizontal channel is commonly considered one of many appropriate patterns for timing the market because the shopping for and promoting factors are in consolidation.

On the time of study, the worth of Injective (INJ) was recorded at $33.70. If the sample development continues, then the worth of INJ would possibly attain the resistance ranges of $36.38 and $43.94. If the development reverses, then the worth of INJ could fall to the assist of $30.36, and $20.92.

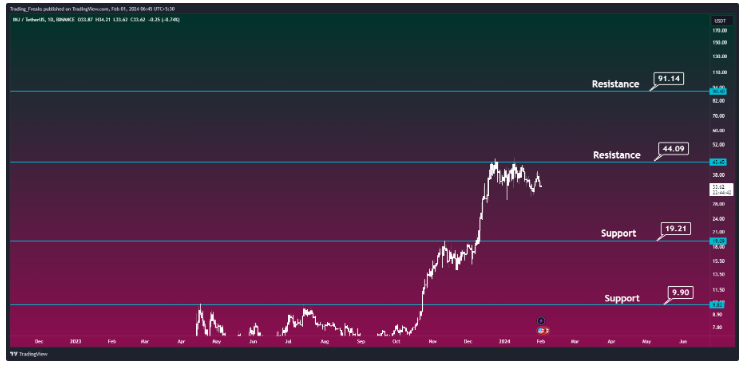

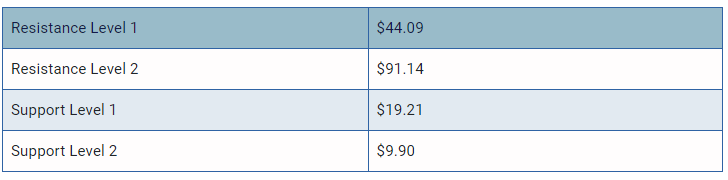

Injective (INJ) Resistance and Help Ranges

The chart given beneath elucidates the attainable resistance and assist ranges of Injective (INJ) in 2024.

From the above chart, we will analyze and establish the next as resistance and assist ranges of Injective (INJ) for 2024.

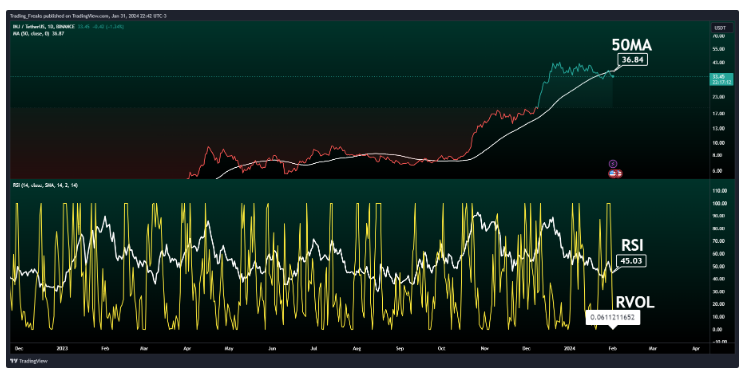

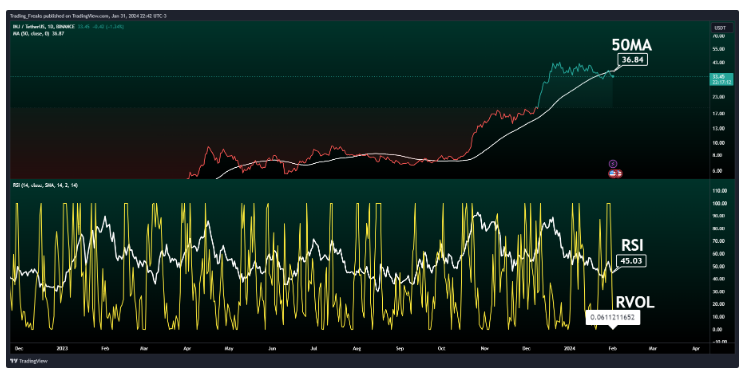

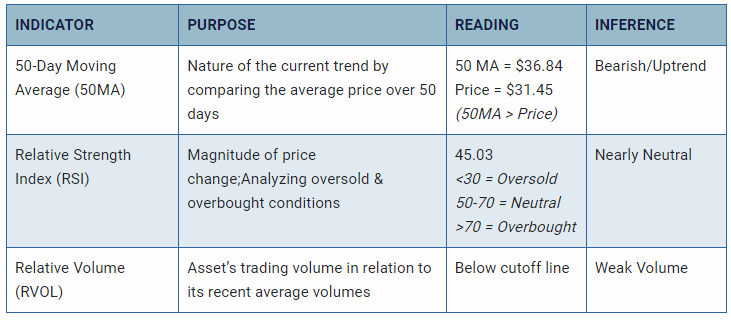

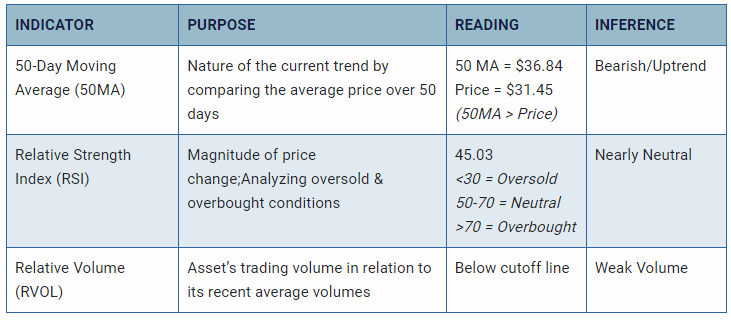

Injective (INJ) Value Prediction 2024 — RVOL, MA, and RSI

The technical evaluation indicators corresponding to Relative Quantity (RVOL), Transferring Common (MA), and Relative Energy Index (RSI) of Injective (INJ) are proven within the chart beneath.

From the readings on the chart above, we will make the next inferences relating to the present Injective (INJ) market in 2024.

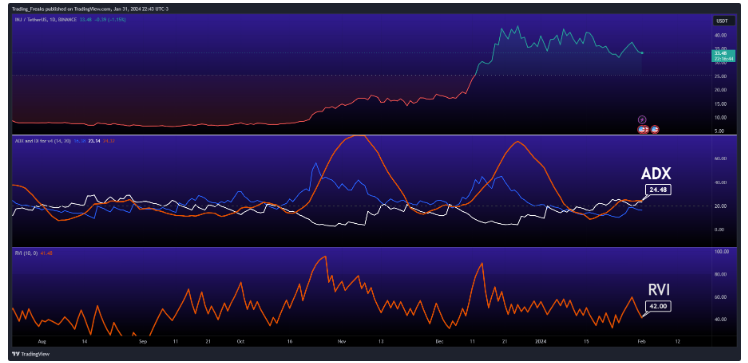

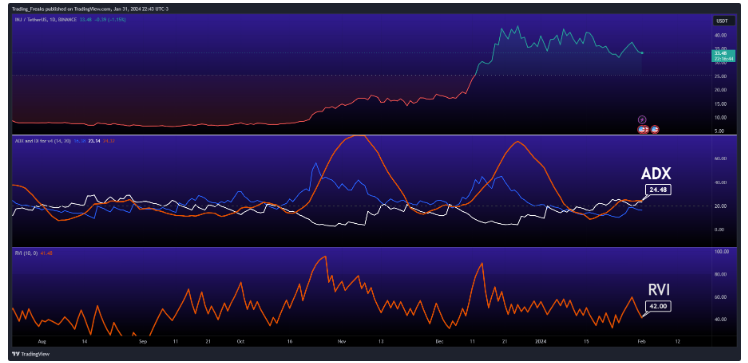

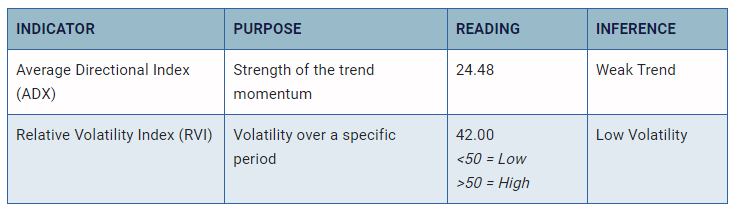

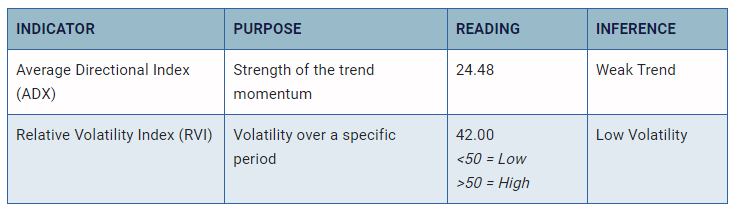

Injective (INJ) Value Prediction 2024 — ADX, RVI

Within the beneath chart, we analyze the energy and volatility of Injective (INJ) utilizing the next technical evaluation indicators — Common Directional Index (ADX) and Relative Volatility Index (RVI).

From the readings on the chart above, we will make the next inferences relating to the worth momentum of Injective (INJ).

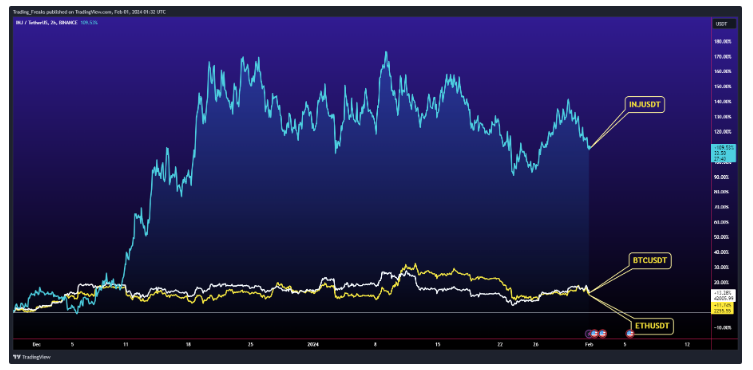

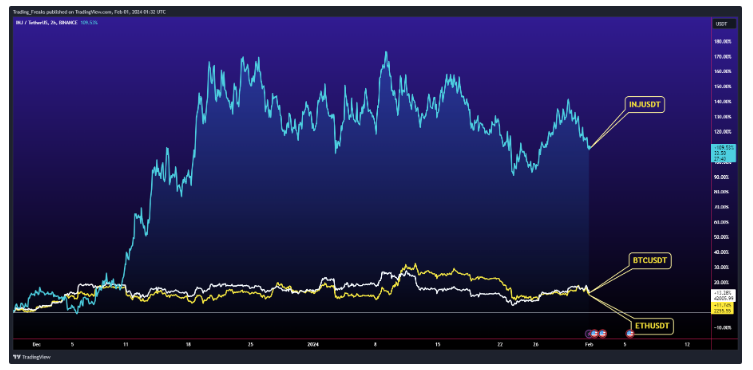

Comparability of INJ with BTC, ETH

Allow us to now evaluate the worth actions of Injective (INJ) with that of (BTC), and Ethereum (ETH).

From the above chart, we will interpret that the worth motion of INJ is dissimilar to that of BTC and ETH. That’s, when the worth of BTC and ETH will increase, the worth of INJ decreases, if the worth of BTC and ETH decreases, the worth of INJ will increase. .

Injective (INJ) Value Prediction 2025, 2026 – 2030

With the assistance of the aforementioned technical evaluation indicators and development patterns, allow us to predict the worth of Injective (INJ) between 2025, 2026, 2027, 2028, 2029 and 2030.

Conclusion

If Injective (INJ) establishes itself as a very good funding in 2024, this yr can be favorable to the cryptocurrency. In conclusion, the bullish Injective (INJ) value prediction for 2024 is $91.14. Comparatively, if unfavorable sentiment is triggered, the bearish Injective (INJ) value prediction for 2024 is $9.90.

If the market momentum and buyers’ sentiment positively elevate, then Injective (INJ) would possibly hit $50. Moreover, with future upgrades and developments within the Injective ecosystem, INJ would possibly surpass its present all-time excessive (ATH) of $45.19 and mark its new ATH.

This content material was initially printed by our companions at The News Crypto.