The cryptocurrency market is teeming with anticipation as the following Bitcoin halving approaches. The pre-programmed occasion halves the variety of Bitcoin rewarded for efficiently mining blocks. For traders, understanding the mechanics and implications of the Bitcoin halving is essential for knowledgeable decision-making and efficient portfolio administration.

By analyzing the historic impression of previous halvings and analyzing present market traits, traders can higher put together for the upcoming halving and higher place themselves within the ever-evolving cryptocurrency panorama.

On this article, the Investing Information Community (INN) teamed up with crypto skilled Peter Eberle to discover the intricacies of the halving course of and focus on the potential market volatility that will come up.

What’s the Bitcoin halving?

Bitcoin is created by means of a course of referred to as mining, through which Bitcoin miners compete with one another to resolve an algorithmic downside. As soon as the issue is solved, a brand new block is added to the blockchain, and the miner who solved the issue is rewarded with a set quantity of newly generated Bitcoin. When Bitcoin was launched in 2009, the reward price was 50 Bitcoin for each block mined.

The Bitcoin halving is scheduled to occur roughly each 4 years or after the mining of 210,000 blocks; the halving is just not triggered by the passing of a particular period of time, and the precise time between halvings can differ barely as a consequence of fluctuations in mining problem and community hash price, which is a measure of the entire computational energy getting used to mine Bitcoin.

This yr’s halving is ready to happen on or round April 20, 2024. The date relies on this estimate, which adjustments with the mining of every new block. Following the three earlier halving occasions, which occurred in 2012, 2016 and 2020, the reward price now sits at 6.25 Bitcoin. The upcoming halving will drop the speed even additional to three.125 Bitcoin per block.

The ideas of the halving are written straight into Bitcoin’s community. By decreasing block rewards, the halving slows down the speed at which new Bitcoins are created. This managed provide is meant to fight inflation so Bitcoin can preserve its worth over time. Because the halving occasions progress, the availability of recent cash will steadily lower till all 21 million Bitcoins are in circulation.

How do halvings impression Bitcoin miners?

Bitcoin’s halving has vital implications for the cryptocurrency’s mining exercise and provide due to how Bitcoin mining works.

The mining process, also referred to as block time, sometimes takes round 10 minutes. To keep up a constant block time, the Bitcoin community adjusts the mining problem based mostly on hash price, a measure of computational energy used to mine Bitcoin and course of transactions. A rise in energy signifies that extra miners are competing to create new blocks and earn Bitcoin rewards, so the puzzle turns into tougher. When fewer miners are competing, the puzzle turns into simpler. This ensures that new blocks are created at a gradual price, no matter what number of miners are competing to create them.

Traditionally, the hash price has risen main as much as halving occasions, solely to drop off within the weeks after as inefficient miners are weeded out.

“One of many issues that occurs is that these miners which have much less environment friendly gear should get out of the enterprise, proper? If they’ve outdated gear and gear that absorbs an excessive amount of vitality, they are not going to have the ability to pay for that when the mining reward drops,” Eberle defined.

At the moment, hash charges that he describes as “record-high” are pushed by massive mining firms introducing new, quicker and extra environment friendly machines whereas nonetheless using older machines that will develop into out of date in a number of months. Mining firms have already been making strikes to this finish in 2024. For instance, Bitcoin miner Riot Platforms purchased new miners in anticipation of the halving on February 27, the identical day that CleanSpark accomplished the acquisition of three knowledge facilities in Mississippi.

This effectivity advantages traders as miners constantly promote Bitcoin to cowl operational prices and make a revenue when manufacturing prices are decrease than the promoting value.

CoinShares steered in its 2024 Crypto Outlook report that miners could also be in “higher form” in 2024 as a consequence of decreased debt, bigger scale of operations and fairness finance choices. Bitcoin’s value has additionally been bolstered by the approval of spot Bitcoin ETFs and the US Federal Reserve’s present plans to ease financial coverage later this yr.

The authors of the report, which was launched in January, predicted that 2024 will probably be a “twin cycle yr.” The sector started the yr in a rebalancing section, which CoinShares expects to persist till after the halving. At that time, it’ll enter the mining gold rush as the value of Bitcoin outpaces miners’ potential to deploy new hash price. The agency estimates that mining 1 Bitcoin will price roughly US$37,856 after the halving.

“So, from an investor standpoint,” Eberle continued, “the rationale the halving is substantial is that these miners, to pay for his or her ongoing operations — whether or not it is electrical energy prices for his or her warehouses (or) shopping for new gear — they seem to be a constant vendor of Bitcoin. So long as their price to supply Bitcoins is decrease than what they’re promoting for, they make a revenue. Inefficient miners will probably be pressured out if they do not do these upgrades.”

How do halvings impression the Bitcoin value?

Bitcoin usually surges main as much as the halving, though, with solely three halvings in historical past, it’s troublesome to assertively establish price trends.

Bitcoin USD value chart 11/21/2012 to 12/05/2013

Chart through TradingView

The primary Bitcoin halving on November 28, 2012, noticed the mining reward drop from 50 to 25 Bitcoins. Whereas Bitcoin was nonetheless a distinct segment product on the time, it had began to realize mainstream consideration, partly as a consequence of economic uncertainty in Europe. Bitcoin’s worth had risen from round US$5.50 in January 2012 to about US$12 by the November halving, indicating a gradual improve in curiosity and adoption. Within the following months, Bitcoin continued to draw consideration and its value grew considerably. By the point a yr had handed after the halving, Bitcoin’s value was US$1,013. This development marked the start of its journey towards mainstream recognition as a possible different asset class. Nonetheless, it was not long-lived, and moved again all the way down to beneath US$300 by mid-2015.

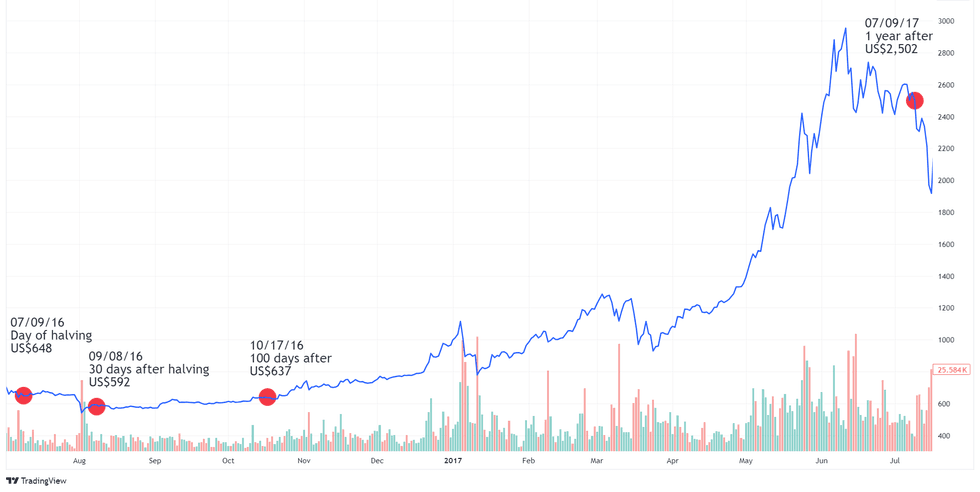

Bitcoin USD value chart 07/02/2016 to 07/16/2017

Chart through TradingView

By the point the second Bitcoin halving occurred on July 9, 2016, the cryptocurrency’s worth had climbed again as much as US$648. Over the next yr, Bitcoin skilled substantial development because the rising pleasure and optimistic sentiment surrounding it resulted in FOMO — concern of lacking out — main extra folks to speculate and pushing the value previous US$2,500 on June 3, 2017.

Large financial institutions started to take discover of blockchain expertise’s potential, which resulted in additional value appreciation for essentially the most well-known cryptocurrency. Bitcoin hit a then all-time excessive of US$19,783.21 in December 2017.

Bitcoin’s total upward pattern on this interval demonstrated the growing curiosity in cryptocurrencies and their potential for substantial long-term development. Nonetheless, rising considerations about potential regulatory crackdowns led many traders to promote their Bitcoin holdings in early 2018, inflicting a decline in its worth.

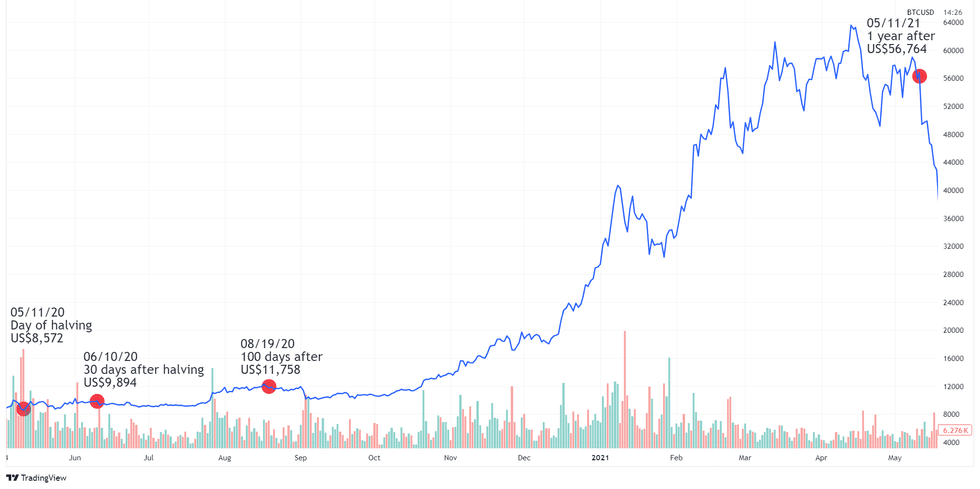

Bitcoin USD value chart 05/04/2020 to 05/18/2021

Chart through TradingView

The latest halving occurred on Might 11, 2020, and it decreased block rewards from 12.5 Bitcoin to the present price of 6.125. Bitcoin’s value on the day of the halving was US$7,935.10. Amidst all that was happening on the planet in 2020, the halving was anticlimactic, with little fanfare and never a lot value motion.

Nonetheless, 2020 grew to become a really influential yr for crypto total, and myriad elements contributed to Bitcoin value motion. The outbreak of COVID-19 hit world economies exhausting, and some experts grew to become frightened that giant stimulus packages may result in inflation and a weakening of fiat currencies. On the time, macro trader Paul Jones and economist Lorenzo Giorgianna named cryptocurrency as a possible safe-haven asset akin to gold, which prompted an inflow of recent traders.

Moreover, pleasure for the decentralized finance business (DeFi) kicked off circa June to September 2020, and billions of {dollars} had been poured into the subsector. By the autumn, the world was awash in DeFi and crypto initiatives as Bitcoin saved gaining momentum, hailed because the “gold standard” amongst digitized currencies. Giant establishments like PayPal (NASDAQ:PYPL) and Sq., now part of Block (NYSE:SQ), started investing in or adopting Bitcoin and different cryptocurrencies, arguably kicking off mainstream adoption.

“I feel cryptocurrency’s right here to remain,” Rick Rieder, chief funding officer of BlackRock, informed CNBC on the time.

Bitcoin ended 2020 valued above US$28,000, and precisely one yr after the 2020 halving it was price round US$56,000. Whereas it faltered in mid-2021, it recovered, and in November 2021, it hit a then all-time excessive of US$68,000.

What we all know in regards to the subsequent Bitcoin halving

Through the years, halvings have stirred up enthusiasm, however 2024’s halving may be essentially the most extremely anticipated given the latest surge in market exercise introduced on largely by the January 10 approval of spot Bitcoin ETFs. Bitcoin ETFs permit risk-avoidant traders to get in on the value motion of Bitcoin with out the effort of shopping for it.

“There are folks that benefit from the thought of having the ability to have their very own {hardware} or software program pockets and custody of Bitcoin itself, however for most individuals, it is fairly intimidating,” Eberle mentioned. “The very last thing somebody needs to do is make a mistake after which lose a considerable quantity of their belongings, proper? And so this ETF, it is not an ideal replication of Bitcoin, but it surely’s definitely a easy option to replicate publicity to Bitcoin. And in order that’s opened it as much as folks that will have by no means purchased Bitcoin in their very own proper.”

After a tough 2022, the latter half of 2023 noticed a crypto renaissance, with legal victories against the SEC and the seemingly promise of spot Bitcoin ETFs bringing extra institutional funding, reigniting religion within the business.

For the reason that US Securities and Change Fee delivered its ruling, the value of Bitcoin has surged to highs not seen since 2021. On February 28, Bitcoin ETFs reached a brand new quantity report of US$7.6 billion. A number of sources have cited the upcoming halving as one of many forces that drove the value of Bitcoin above its earlier highest worth of US$69,000 on March 5. Demand for Bitcoin ETFs surged tenfold in comparison with miners towards the tip of February.

“The demand facet is definitely impacted by (the ETFs),” he mentioned. “And one of many issues that has occurred beforehand earlier than the halvings is that there’s some promote strain from the miners as a result of they’re upgrading their gear. And it seems like this time that offer that is coming into the market is being absorbed by these ETFs. So historically, we have seen a pullback within the couple of months previous to the halving after which an actual acceleration to the upside as soon as the halving occurs. And this time, we could also be beginning the method somewhat bit earlier, in that further provide that the miners may be placing on {the marketplace} is already being absorbed by these ETFs, which may result in some fairly spectacular beneficial properties afterward within the yr.”

The best way to make investments forward of the Bitcoin halving?

Peter Brandt, an analyst and the CEO of Issue, predicted on X, previously referred to as Twitter, that the value of Bitcoin may go as excessive as US$200,000 by September, a 66 % bounce from his earlier estimate of US$120,000.

“We consider new all-time highs will probably be made,” Eberle mentioned. “We predict it will go (on a run) as soon as that occurs due to the convenience with which one should buy the ETFs now. …The retail FOMO that is available in may drive the value to some unbelievable ranges, after which I am positive we’ll have one other pullback.

“However I’ve seen estimates anyplace from US$75,000 to US$150,000, which I feel are affordable within the subsequent 12 to 18 months. A few of these larger numbers, I feel these are for headlines greater than the rest. However we’ll be pleased, we’re entering into all-time highs and folks not being down on the area. I feel that will be a optimistic.”

For these trying to put money into Bitcoin, Eberle shared his recommendation for utilizing Bitcoin to stability out an funding portfolio, particularly its impact on the usual 60/40 fairness bond portfolio, which might be rebalanced quarterly by promoting the asset that carried out higher and shopping for the opposite asset to reinforce efficiency over time.

Eberle defined that often rebalanced portfolios can profit from risky belongings, and mentioned research present that together with a 3 to five % allocation of Bitcoin in a regular 60/40 portfolio may lower total portfolio volatility and improve anticipated returns. It is because the non-correlated, extremely risky asset makes the funds transfer backwards and forwards extra throughout rebalancing.

“One space that is vital to portfolio administration, whether or not it has to do with Bitcoin or something, is that if the volatility of an funding is holding you up at night time, it is not the volatility of the funding, however moderately the dimensions of your allocation to that funding,” Eberle suggested.

Remember to comply with us @INN_Technology for real-time information updates!

Securities Disclosure: I, Meagen Seatter, maintain no direct funding curiosity in any firm talked about on this article.

Editorial Disclosure: The Investing Information Community doesn’t assure the accuracy or thoroughness of the data reported within the interviews it conducts. The opinions expressed in these interviews don’t mirror the opinions of the Investing Information Community and don’t represent funding recommendation. All readers are inspired to carry out their very own due diligence.

From Your Website Articles

Associated Articles Across the Internet