Bitcoin (BTC) miners are reportedly hedging in opposition to the current downturn in costs by mining different cryptocurrencies, in accordance with the CEO of CryptoQuant.

Ki Younger Ju says that Bitcoin’s hashprice is now at an all-time low, doubtlessly inflicting a slowdown in investments for mining corporations and prompting them to look to different, cheaper proof-of-work (PoW) cash to mine in the intervening time.

Hashprice refers back to the anticipated worth of 1 TH/s of hashing energy per day and goals to quantify how a lot a miner can count on to earn from a given quantity of hashrate.

Says Ju,

“Bitcoin hashprice hit an all-time low. Many mining corporations slowed mining rig investments, with some switching to different PoW cash to hedge in opposition to market uncertainty…

This doesn’t imply the tip of the cycle. And so they’re not long-term bearish; they’re simply hedging and ready for buy-side liquidity to get well, in my view.”

Nonetheless, Ju agrees that the development signifies a capitulation in miners, which is usually a attribute of a pre-Bitcoin bull run.

At time of writing, BTC is buying and selling at $60,681.

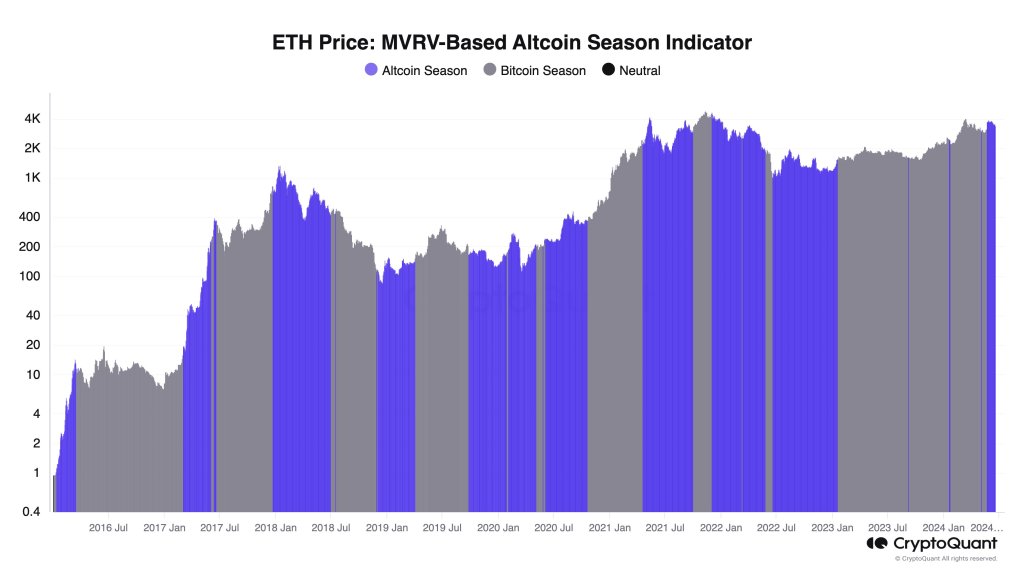

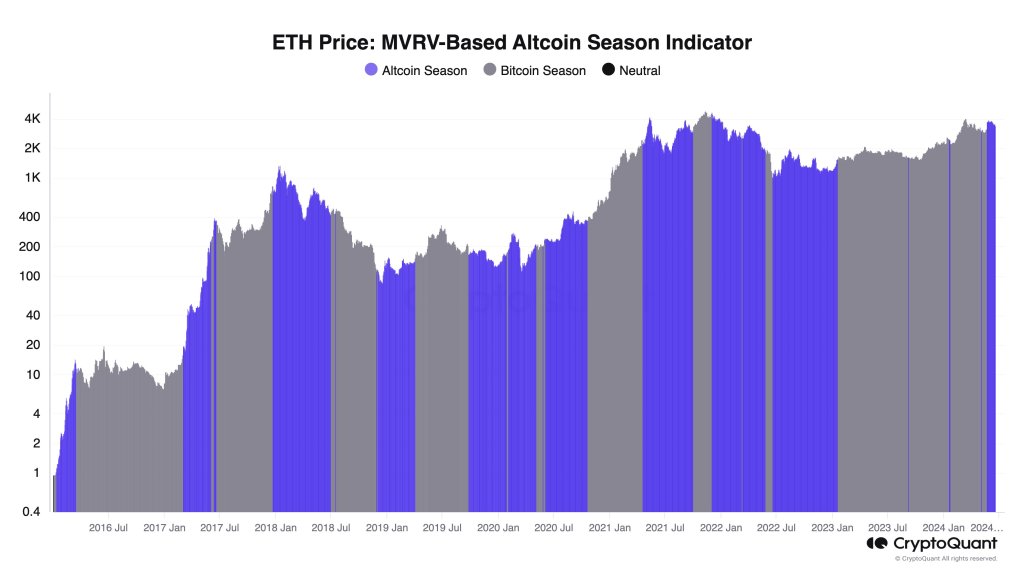

Lately, Ju mentioned that Ethereum’s (ETH) Market Worth to Realized Worth (MVRV) indicator was signaling the start of an altseason.

The MVRV indicator, which is used to evaluate whether or not a specific crypto asset is undervalued or overvalued, is the ratio of the market capitalization of Ethereum, or every other crypto asset, relative to its realized capitalization (the worth of all ETH on the worth they have been purchased).

“We’re coming into early altcoin season.

ETH MVRV is rising quicker than Bitcoin (BTC) MVRV, suggesting ETH market is heating up relative to its on-chain fundamentals.

Given the present ETF scenario, this is likely to be an ETH-only season. Traditionally, when ETH surges, different altcoins are likely to comply with.”

ETH is buying and selling at $3,360 at time of writing.

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Value Motion

Observe us on X, Facebook and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal threat, and any losses you could incur are your accountability. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please notice that The Day by day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney