- Lengthy-term holders have begun to distribute their cash.

- On-chain knowledge advised that Bitcoin was overheated.

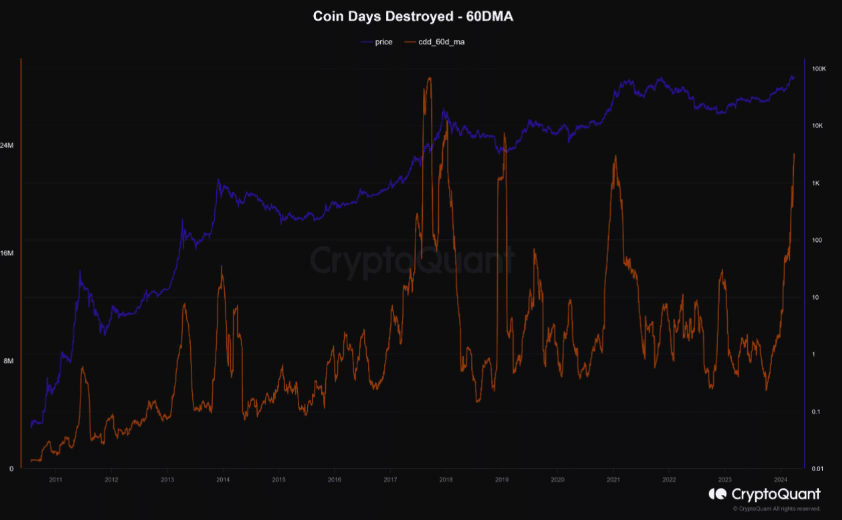

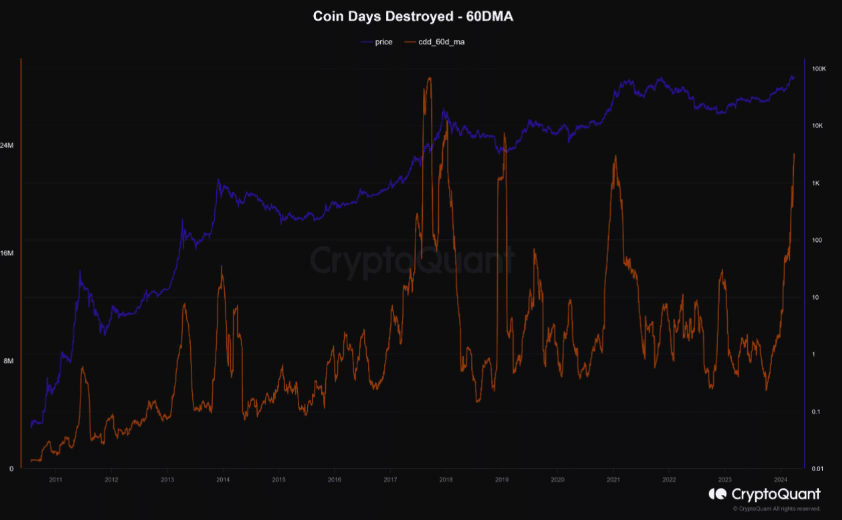

Bitcoin’s [BTC] Coin Days Destroyed (CDD) has hit a five-year excessive, in response to knowledge from CryptoQuant. Maartunn, an writer of the on-chain analytic platform, additionally mentioned this in a current piece.

Coin Days Destroyed measures the variety of days Bitcoins have been inactive multiplied by the amount transacted.

Traditionally, when the CDD hits a peak on the 60-day Shifting Common (MA), it implies that long-term holders are distributing their cash.

Supply: CryptoQuant

When this occurs, Bitcoin skilled a big correction. Maartunn, in his put up additionally admitted it saying,

“This sample signifies that throughout the bullish part, there’s a distribution of older cash. In historic contexts, it could take as much as 5 months for Bitcoin to achieve its peak.”

Cuts within the center

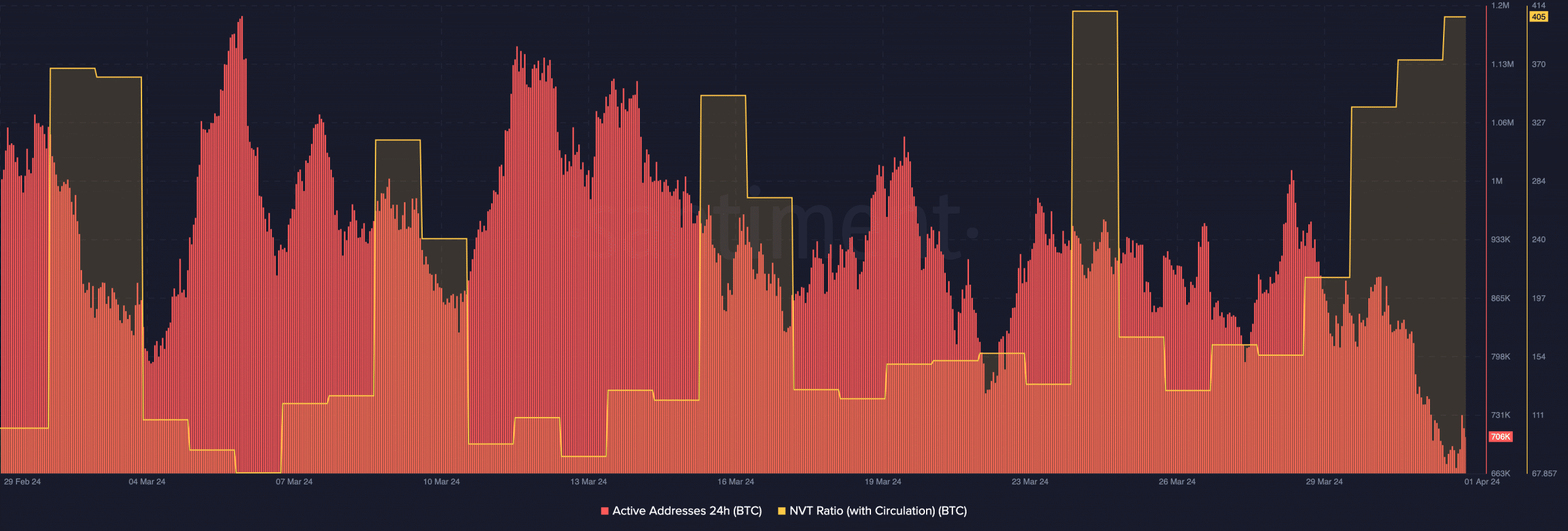

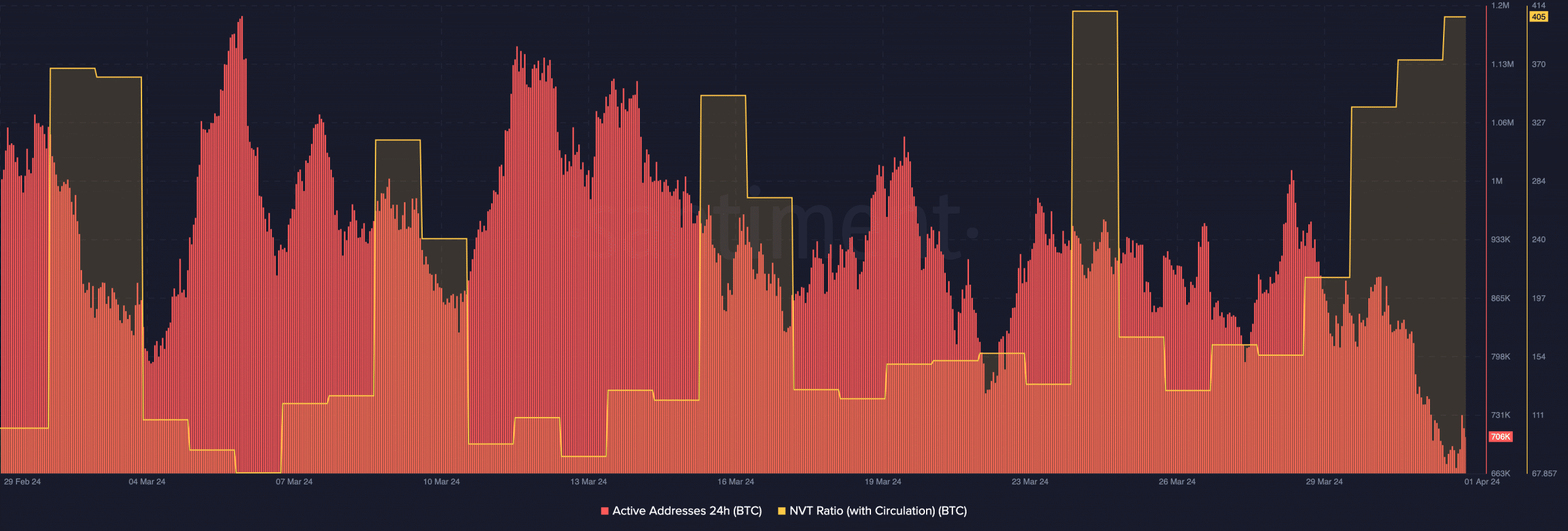

At press time, BTC modified fingers at 69,663, indicating that the coin has been transferring sideways within the final 24 hours. Additional insights into Bitcoin’s on-chain standing confirmed that exercise on the community had decreased.

As of this writing, the 24-hour lively addresses had been 706,000. A number of days again, the metric was above 1 million. Due to this fact, the current lower implies that BTC’s profitable transactions have declined.

If the community lacks spectacular exercise, then the worth may be affected since demand may be low. Ought to this be the case, the worth of Bitcoin might drop under $69,000.

Moreover the lively addresses, AMBCrypto additionally looked on the Community Worth to Transactions (NVT) ratio. This metric tells if an asset is overvalued or undervalued, relying on the capability to transact cash.

A low NVT ratio means that transaction quantity is rising quicker than the market cap. On this occasion, investor sentiment may be termed bullish.

Supply: Santiment

Nonetheless, Bitcoin’s NVT ratio was excessive at 405, indicating that investor sentiment was bearish. This comparatively excessive community ratio was an indication that BTC was overvalued, contemplating the present market situation.

It’s both right here or there

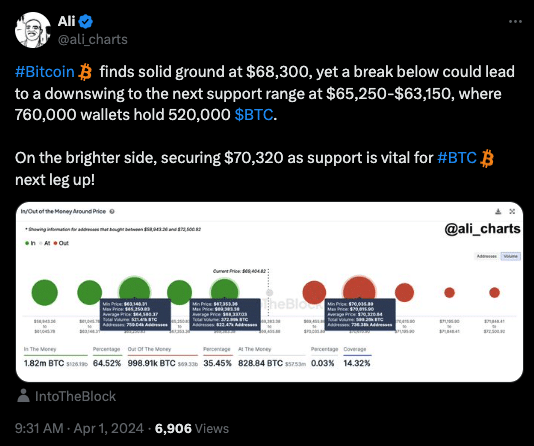

Crypto analyst Ali Martinez, in a put up on X (previously Twitter), additionally shared his short-term view on Bitcoin.

In keeping with Martinez, the worth of the coin would possibly drop to $63,150 if bulls fail to carry on to the $68,300 assist.

Alternatively, the analyst talked about that Bitcoin’s value would possibly transfer greater if the coin retests $70,320.

Supply: X

From the look of issues, Bitcoin’s value would possibly lower earlier than the halving, which is due on the nineteenth of April. In keeping with historical past, the coin experiences excessive volatility each time the halving approaches.

Is your portfolio inexperienced? Try the BTC Revenue Calculator

This time, it may not be completely different. But it surely appeared like Bitcoin was nearly executed with its pre-halving rally, and a downturn could possibly be subsequent.

Within the meantime, BTC would possibly surpass the $70,000 area this cycle. Nonetheless, the present circumstances counsel that it’d solely occur after the four-year occasion.