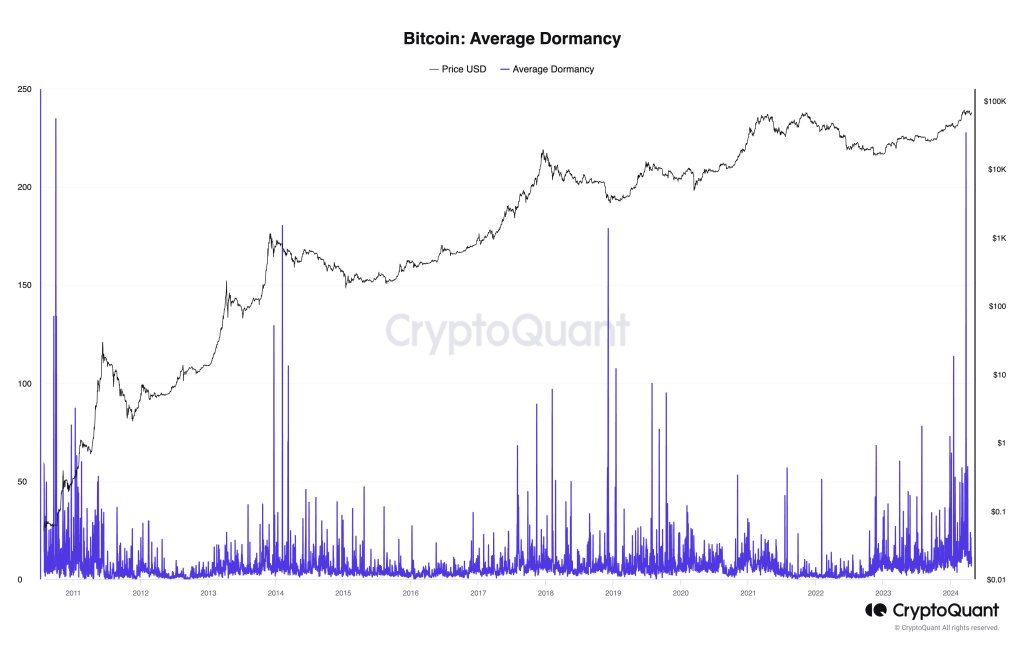

Whereas Bitcoin struggles to increase good points, on-chain knowledge shared by Ki Younger Ju, the founding father of CryptoQuant, on X shows elevated motion of outdated cash. Because the Bitcoin Common Dormancy chart exhibits, this development just lately hit a 13-year excessive.

Extra Previous Whales Shifting Cash

The Bitcoin Common Dormancy exhibits the typical variety of days every BTC has been dormant. On-chain knowledge signifies that cash held for 3 to five years have modified palms and moved to new house owners.

Whereas there was motion, apparently, knowledge exhibits that they weren’t transferred to exchanges. As a substitute, it’s extremely doubtless that they had been traded over-the-counter (OTC).

Normally, any switch to centralized exchanges like Binance or Coinbase may counsel the intention of promoting. The extra cash hit these exchanges, particularly from whales, the upper the possibility of value dumping. Nevertheless, if trades are made through OTC, the influence on spot charges is negligible, which is a optimistic for bulls.

Additional evaluation of those transfers utilizing the Spent Output Revenue Ratio (SOPR) indicator means that whales transferring them made first rate earnings. Traditionally, every time whales dump and register earnings, costs are inclined to dip.

Will Bitcoin Costs Retest All-Time Highs

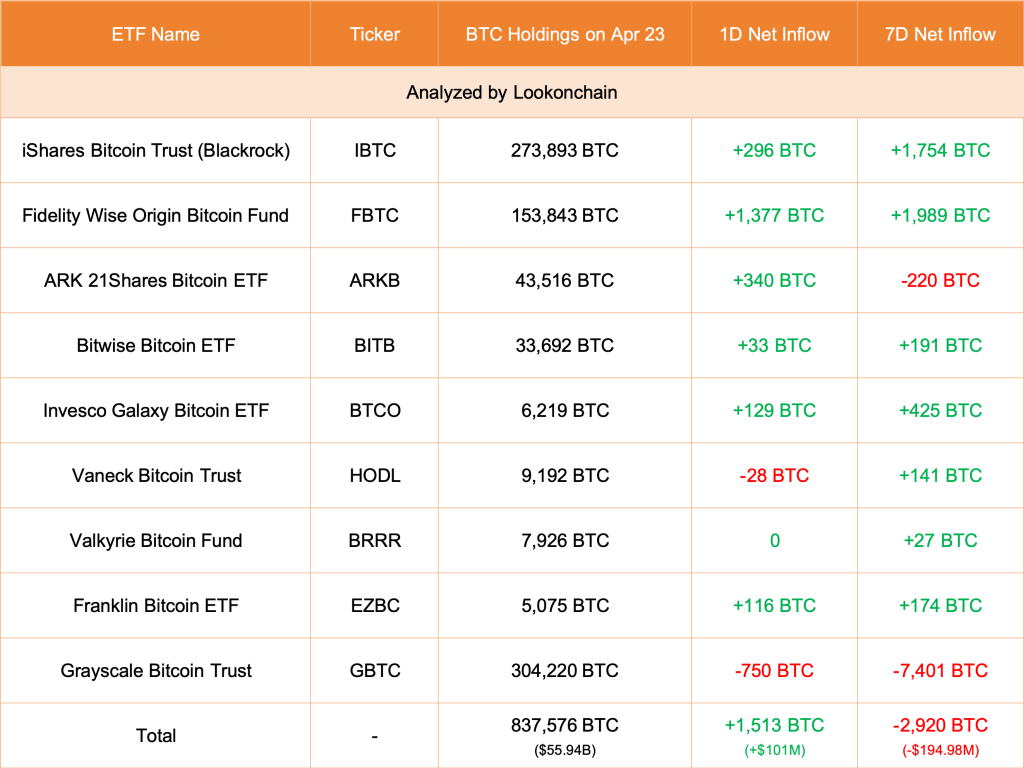

Nevertheless, in a put up on X, one analyst says costs will doubtless enhance due to the influence of spot Bitcoin exchange-traded funds (ETFs). These derivatives are like a buffer towards value drops, contemplating the tempo of inflows prior to now weeks.

Spot ETFs permit establishments to realize regulated publicity to BTC. Coupled with lowering outflows from GBTC, the percentages of costs rising stay elevated.

In line with Lookonchain data, GBTC unloaded 750 BTC on April 23. Nevertheless, Constancy and different eight spot ETF issuers purchased 1,513 BTC on behalf of their purchasers. Spot Bitcoin ETF issuers promote shares representing BTC holdings. These cash will be bought from secondary markets like Binance, through OTC platforms, or straight from miners.

BTC costs stay muted and capped beneath $68,000, representing April 13 highs.

To outline the uptrend, there have to be a excessive quantity growth above this liquidation line, reversing current losses.

Even so, trying on the BTCUSDT candlestick association within the each day chart, bulls should break above all-time highs for a transparent development continuation. Ideally, the uptick above $73,800 and the present vary ought to be with increasing volumes, confirming the presence of consumers.

Function picture from DALLE, chart from TradingView