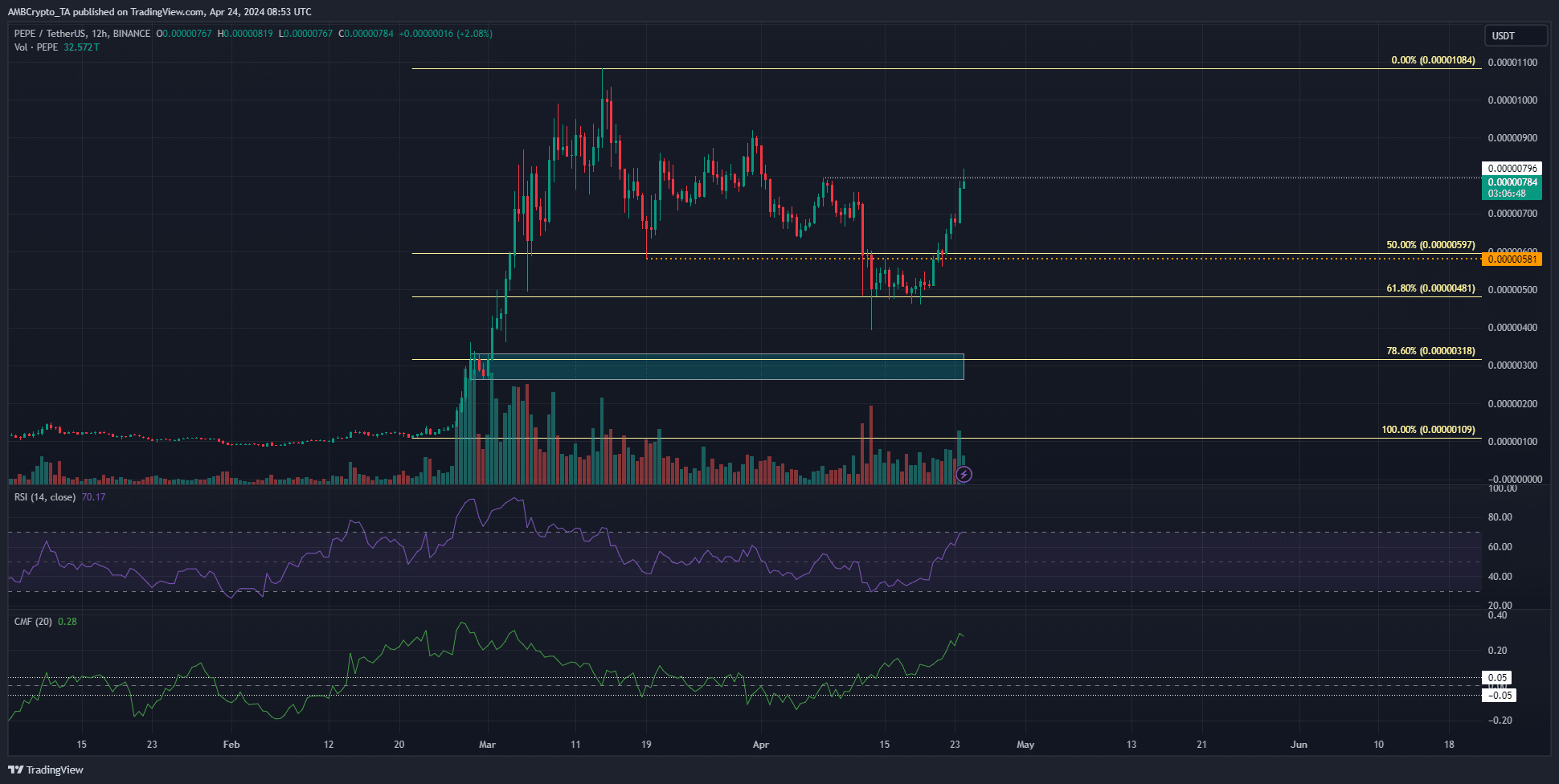

- PEPE retained its larger timeframe bullish construction and was about to flip the H4 construction upward as properly

- The enhance in buying and selling quantity conveyed a bullish conviction

Pepe [PEPE] bulls confirmed they had been no slouches. Regardless of the market-wide stoop over the previous two weeks, the meme coin noticed a wave of shopping for that pushed costs larger by near 70% in 5 days as of press time.

The Coinbase launch of the memecoin’s perpetual contracts performed an element in its restoration. Nevertheless, there was additionally motive to be cautious of its good points.

The current decrease excessive was underneath assault by PEPE patrons

Supply: PEPE/USDT on TradingView

PEPE bulls managed to wrest management of the $0.00000581 stage from the bears. This was the second signal of power from the bulls previously ten days. The primary signal was their protection of the 61.8% Fibonacci retracement stage.

The patrons didn’t permit a 12-hour buying and selling session to shut beneath the extent. Mixed with the flip of $0.00000581 to help, the bullish power was an excessive amount of to deal with. PEPE exploded larger to check the native decrease low at $0.00000796.

At press time, it was buying and selling slightly below this key stage. The RSI was at 70 and confirmed intense upward momentum. The CMF’s studying of +0.28 additionally mirrored noteworthy capital move into the market. General, additional good points had been extra possible.

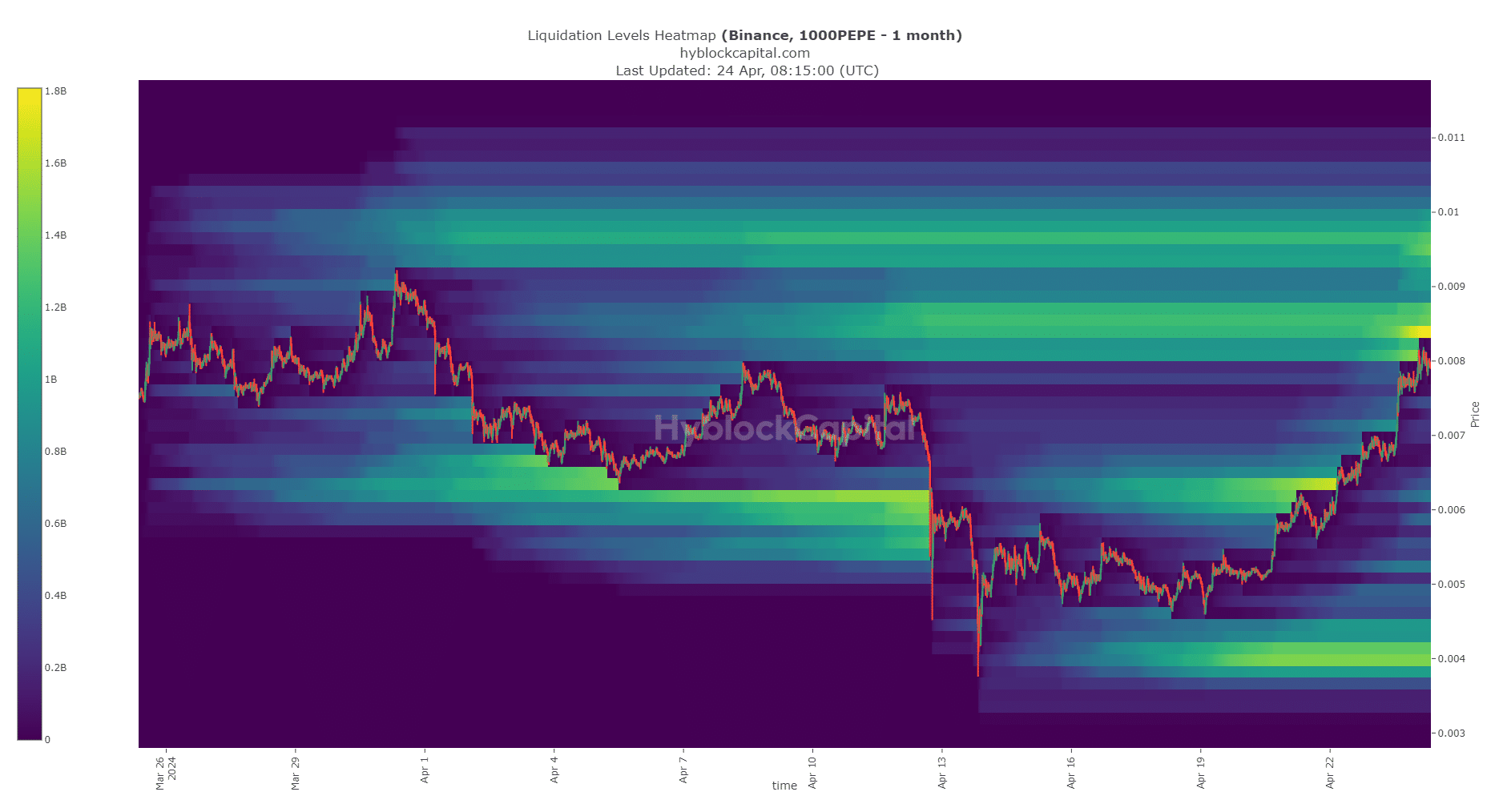

Will we see a brief squeeze on PEPE?

AMBCrypto analyzed the liquidation heatmap of PEPE utilizing knowledge from Hyblock. The $0.000008-$0.00001 area was stuffed with liquidation ranges of sizeable focus. The closest and largest liquidity pocket was at $0.0000084.

A PEPE transfer simply past this stage would set off the quick liquidation orders. Their market purchase orders would pressure costs larger, hitting an growing variety of quick liquidations.

Is your portfolio inexperienced? Examine the Pepe Revenue Calculator

It may rapidly turn out to be a liquidation cascade and drive costs above $0.00001 a minimum of momentarily.

Therefore, merchants have to be cautious of short-term volatility. Given the momentum and demand behind the meme coin, additional good points had been possible and a retracement from $0.0000084 was unbelievable.

Disclaimer: The knowledge offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.