Ethereum worth (ETH USD) is pushing up amid scaling, primarily by means of layer-2s, but one analyst predicts the way forward for blobs will pump ETH worth.

Ethereum

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Worth

Buying and selling quantity in 24h

<!–

?

–>

Final 7d worth motion

has a scaling drawback, true.

In contrast to Solana and different “trendy” chains, the legacy chain can solely course of roughly 15 transactions each second.

At this throughput stage, it’s unattainable to run one other “Fb” or “Twitter” on the bottom layer with out the community breaking.

Ethereum Constructing, Layer-2s Booming

To resolve this huge drawback, builders, led by Vitalik Buterin, proposed a number of measures to maintain charges low whereas guaranteeing the blockchain expands, internet hosting extra dapps.

Polygon

.cwp-coin-chart svg path {

stroke: ;

stroke-width: ;

}

Worth

Buying and selling quantity in 24h

<!–

?

–>

Final 7d worth motion

grew to become a well-liked sidechain, and POL (beforehand MATIC) benefited, hovering at the very least 50X within the final bull run in 2021.

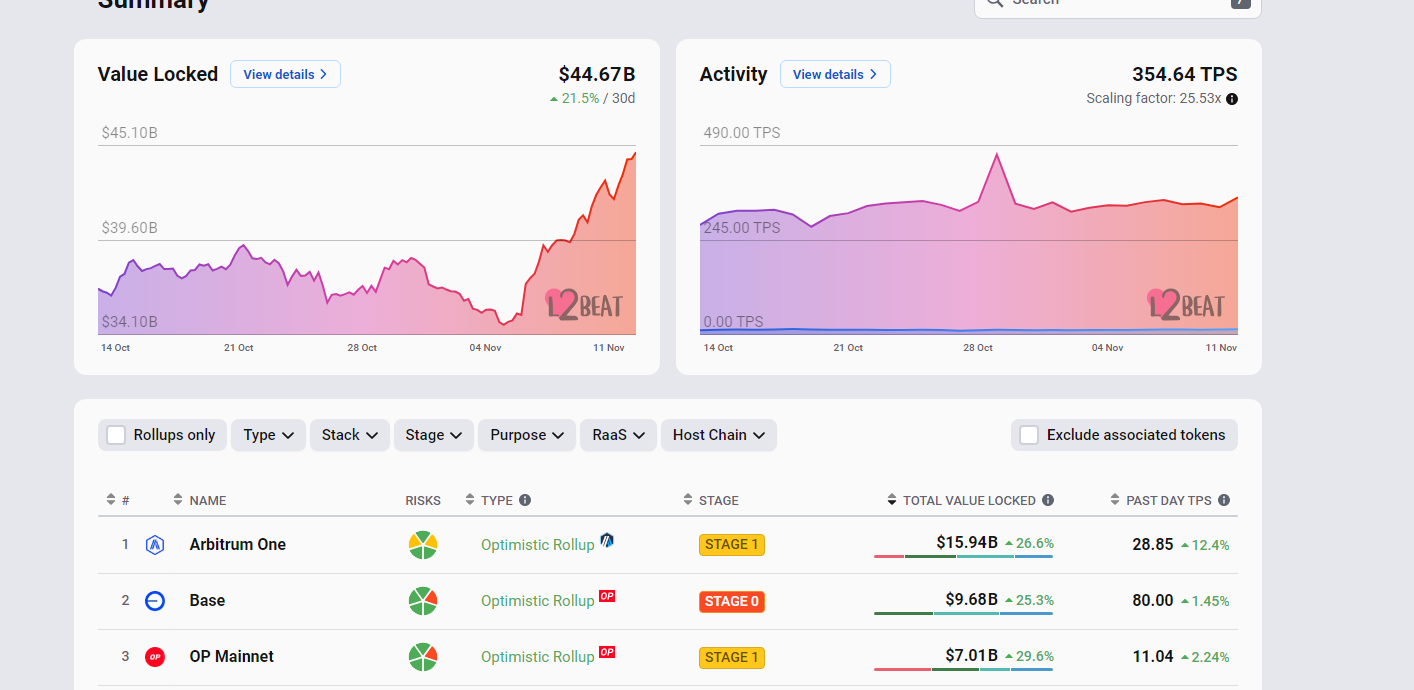

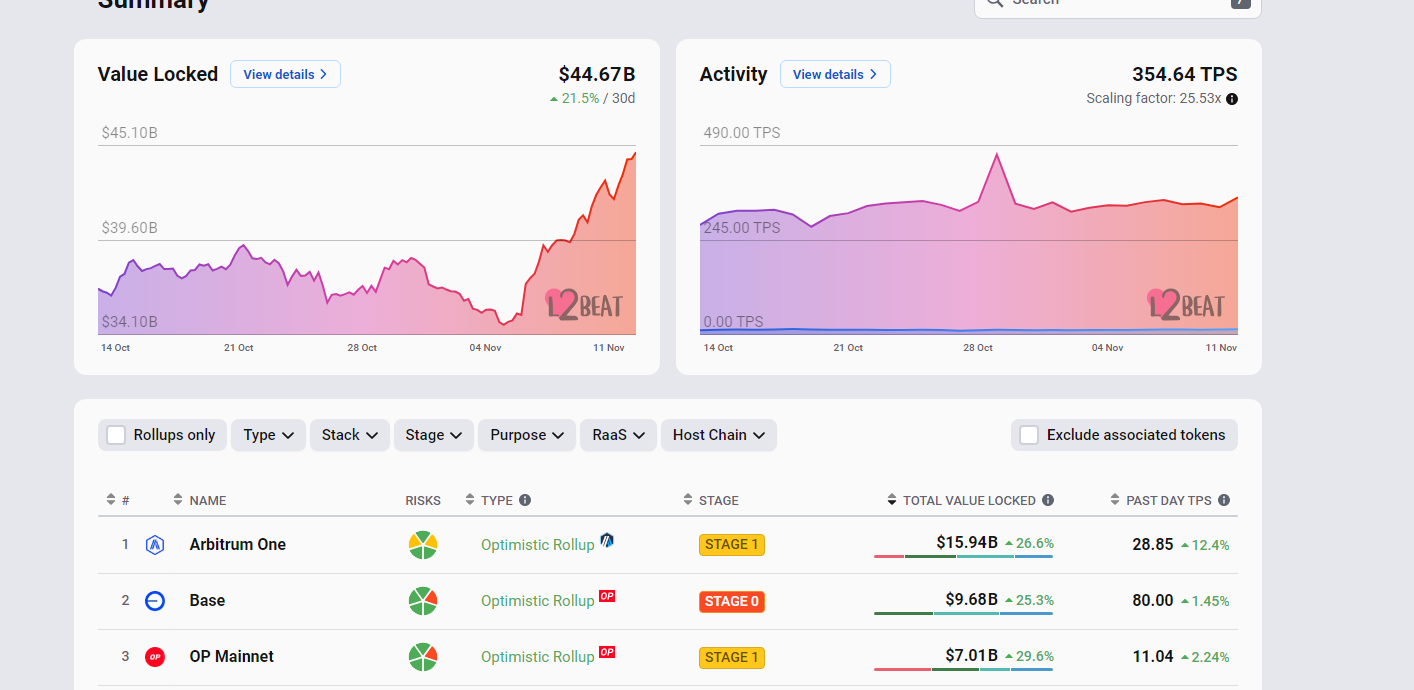

Afterward, it was time for layer-2 options like Arbitrum, Optimism, and, currently, Base to take over. Cumulatively, all layer-2 platforms, a few of which use Polygon zk-Rollup tech, command over $39 billion in belongings.

(Source)

As many layer-2s sprout, promising to scale Ethereum, questions are being requested about how sustainable the bottom layer might be and whether or not these new options are parasitic.

The argument is that at any time when transactions are rerouted from the principle internet, batched, after which confirmed, validators are, merely put, ripped off.

Critics keep that validators who work arduous ought to be compensated pretty.

Presently, layer-2s are ridding unfairly, reaping increased revenues whereas paying pennies to validators, particularly after the discharge of blobs.

After Dencun, blobs made transacting on Ethereum layer-2s practically 90% cheaper. Accordingly, it spurred development in Base and different alternate options, however income didn’t trickle all the way down to validators, resulting in fewer ETH being burned.

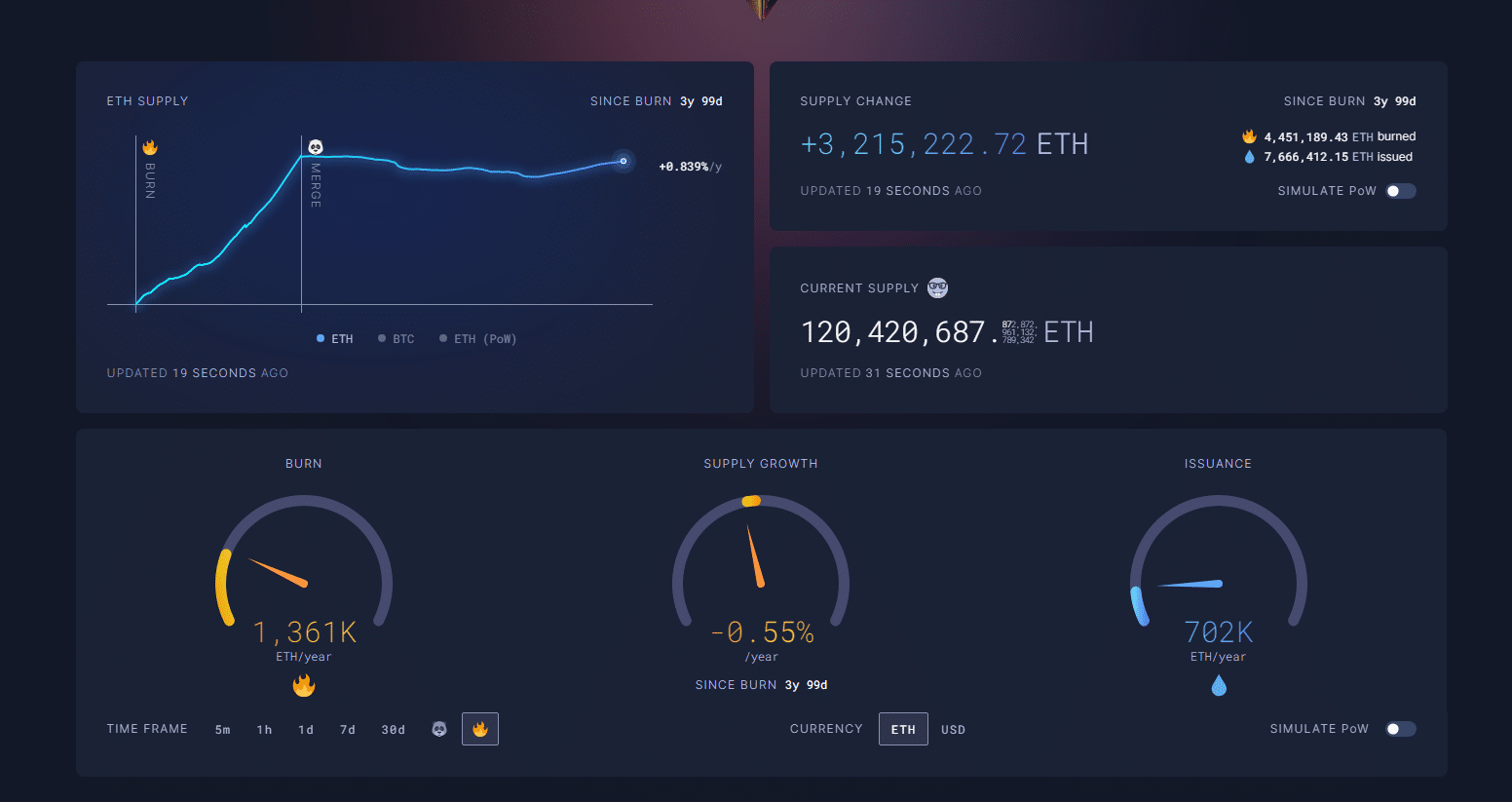

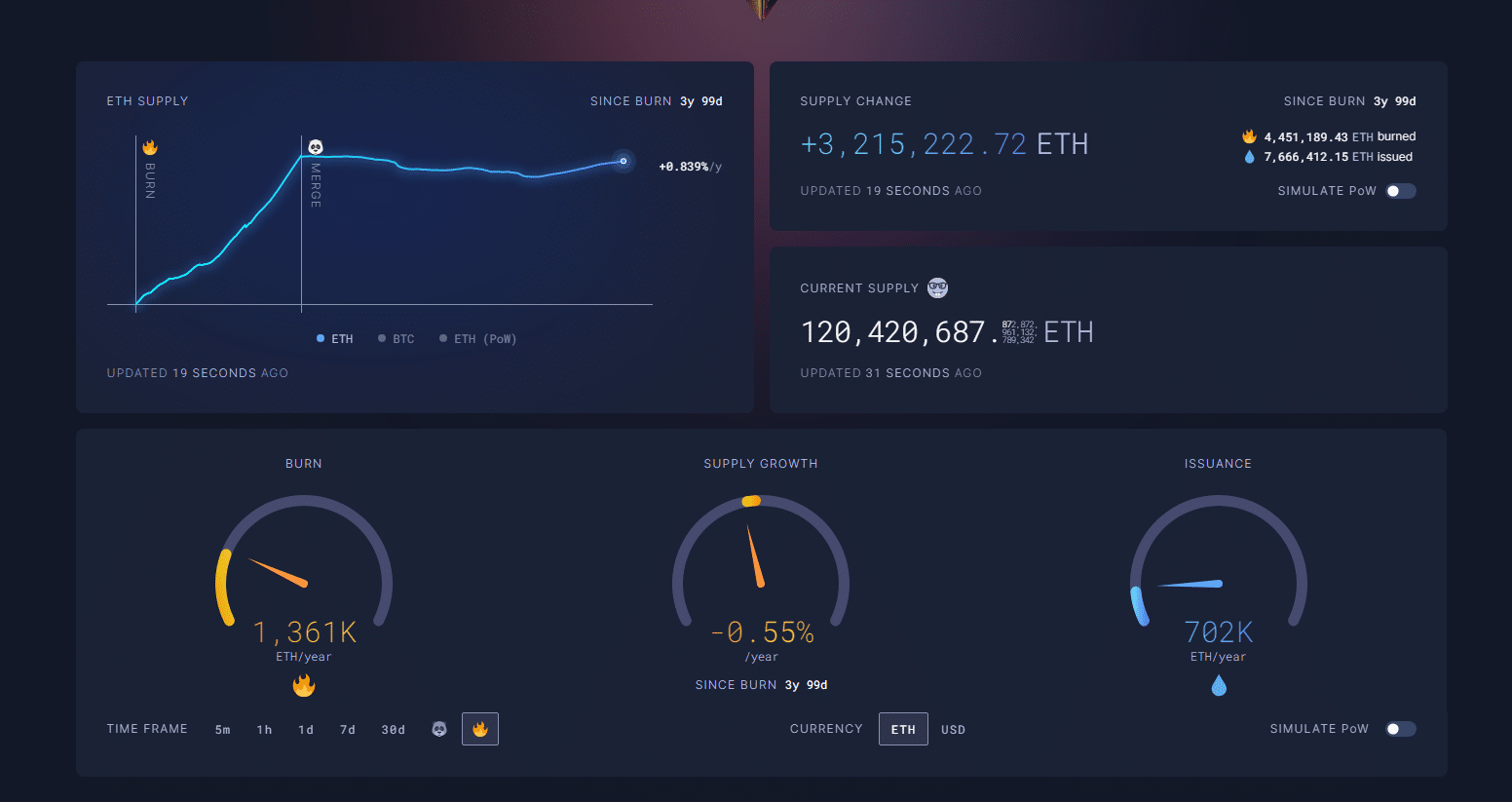

UltraSoundMoney knowledge, ETH turned from deflationary to inflationary. Coincidently, since Dencun, ETH costs have been tanking, dropping from $4,100 in Might to as little as $2,100 in early August.

DISCOVER: These Altcoins Are Anticipated to Explode From Trump Crypto Bull Run

Blobs Are Huge For ETH Demand

One analyst now argues that though Ethereum layer-2s have their points, blobs will significantly profit ETH bulls within the lengthy haul.

In a put up on X, he predicts blobs will gas demand for the second most useful coin, making ETH deflationary whereas concurrently enhancing community scalability.

To know why, you must take a look at how blobs work.

(Source)

Blobs are a brand new function that was launched after Dencun. They act as momentary knowledge packets, making layer-2 transactions environment friendly and reasonably priced.

Sooner or later, these momentary storage packages will deal with 16 MB of information. Accordingly, it will likely be doable for nodes to course of extra transactions. Apparently, this might be no matter how lively the principle internet is.

As soon as Sharding is reside, the principle internet might be scalable. On the identical time, the validator community might be extra distributed, leading to much more capability for blobs.

The analyst explains that the demand for ETH won’t come from blob charges, that are projected to drop much more. As a substitute, it would come from apps launching on layer-2s.

DON’T MISS: This Is The Quickest And Best Approach to Purchase Ethereum in 2024

Sharding Will Be Essential For Way forward for Ethereum

Extra importantly, as soon as Sharding is reside, layer-2s gained’t be seen as aggressive however complementary since each are equally scalable, with rollups depending on the principle internet for safety and settlement.

For now, builders are constructing. Till Sharding goes reside as a part of Ethereum 2.0, layer-2s proceed to play a essential position in primary internet scaling. This improve will assist the community stand up to stiff competitors from Solana and others.

The growth in layer-2s is driving innovation and funneling extra demand for ETH. Platforms like Pepe Unchained, a meme coin layer-2 platform for Ethereum, are already trending and have raised over $26 million.

Traders count on costs to soar on launch as builders put together to launch meme cash on the Pepe Chain. On this manner, they may merely take over from Pump.enjoyable on Solana and SunPump from Tron.

EXPLORE: Dogecoin Pre-Election Pump: Will Division of Authorities Effectivity Be Created By Trump?

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The put up No, Ethereum Layer-2s Are Not Parasitic: They’re Huge for ETH Demand appeared first on .