Predicting Bitcoin’s value has at all times been a scorching matter for buyers. Matt Crosby, lead market analyst at Bitcoin Magazine Pro, explores this matter in his latest video, “Truth About Bitcoin Stock To Flow, Power Law & Price Models“. Right here, we break down Crosby’s key insights to assist buyers improve their Bitcoin methods.

Inventory-to-Circulation (S2F): A Helpful Instrument, Not a Crystal Ball

The Stock-to-Flow (S2F) mannequin is without doubt one of the hottest methods to foretell Bitcoin costs, and Crosby explains its advantages and downsides clearly.

Key Takeaways:

- What Is S2F? S2F assesses Bitcoin’s shortage by evaluating the “inventory” (present provide) to the “circulate” (newly mined cash), much like how uncommon commodities like gold are evaluated.

- Up to date Predictions: The Cross-Asset S2F mannequin initially forecasted Bitcoin hitting $288,000 between 2020 and 2024. Extra just lately, it prompt a doable valuation of $420,000 by April 2025.

- Limitations: S2F works till sudden occasions—like international financial adjustments—disrupt Bitcoin’s standard patterns. Crosby aptly factors out, “S2F works till it doesn’t.”

Whereas S2F is a useful information, it is important for buyers to think about broader market circumstances and macroeconomic influences alongside it.

Bitcoin Energy Regulation: The Lengthy-Time period View

Crosby additionally explores the Bitcoin Energy Regulation, a mannequin that makes use of a log-log chart as an example Bitcoin’s historic value patterns.

Why It Issues:

- Logarithmic Scaling: Through the use of logarithmic scaling, the Energy Regulation highlights Bitcoin’s long-term development of decreased volatility and moderated progress.

- Limitations: This mannequin affords insights for the lengthy haul however is much less useful for short-term predictions or market surprises.

For buyers aiming to diversify their portfolios and strategically time their investments, the Energy Regulation gives context however ought to be used with different, extra dynamic instruments.

Actual-Time Metrics: The Key to Adaptability

Crosby emphasizes the boundaries of static fashions like S2F and the Energy Regulation, advocating for real-time, data-driven approaches as an alternative.

Instruments Traders Ought to Use:

- MVRV Z-Score: Measures market cap in opposition to realized cap, figuring out when Bitcoin is overvalued or undervalued.

- SOPR (Spent Output Profit Ratio): Gives insights into market sentiment by monitoring profit-taking habits.

- On-Chain Metrics: Metrics like Bitcoin’s realized price and value-days-destroyed assist detect market turning factors.

These metrics give buyers the instruments to adapt their methods to the market’s habits in real-time relatively than relying solely on predictions.

Why Exterior Elements Matter

Crosby cautions in opposition to relying solely on Bitcoin-specific knowledge, emphasizing the significance of exterior elements:

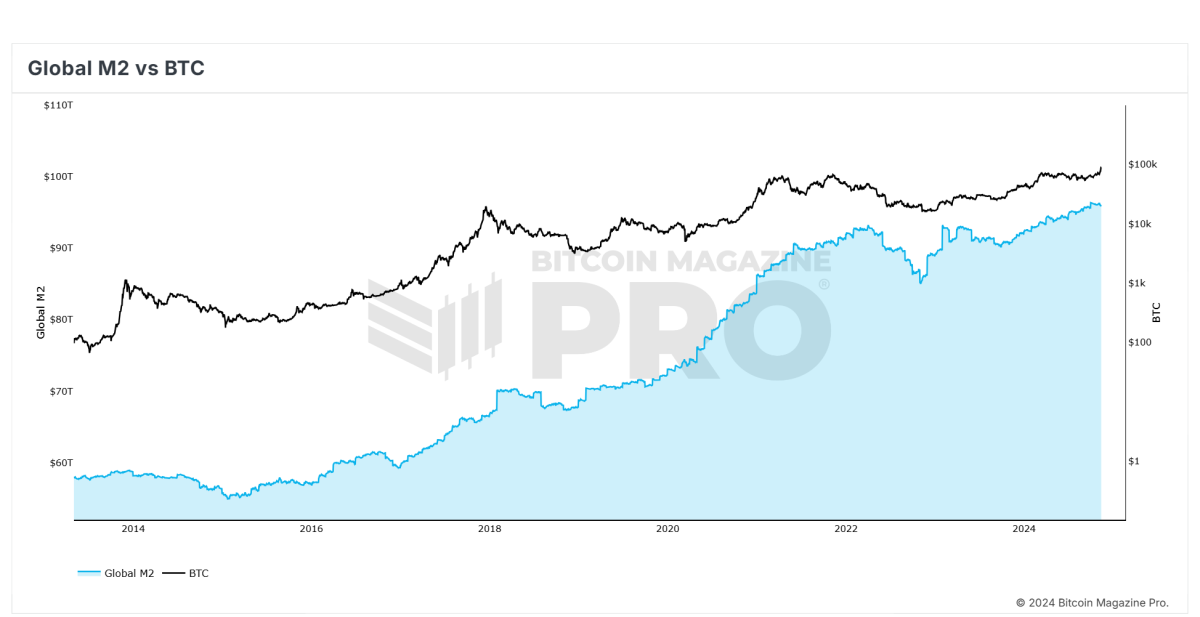

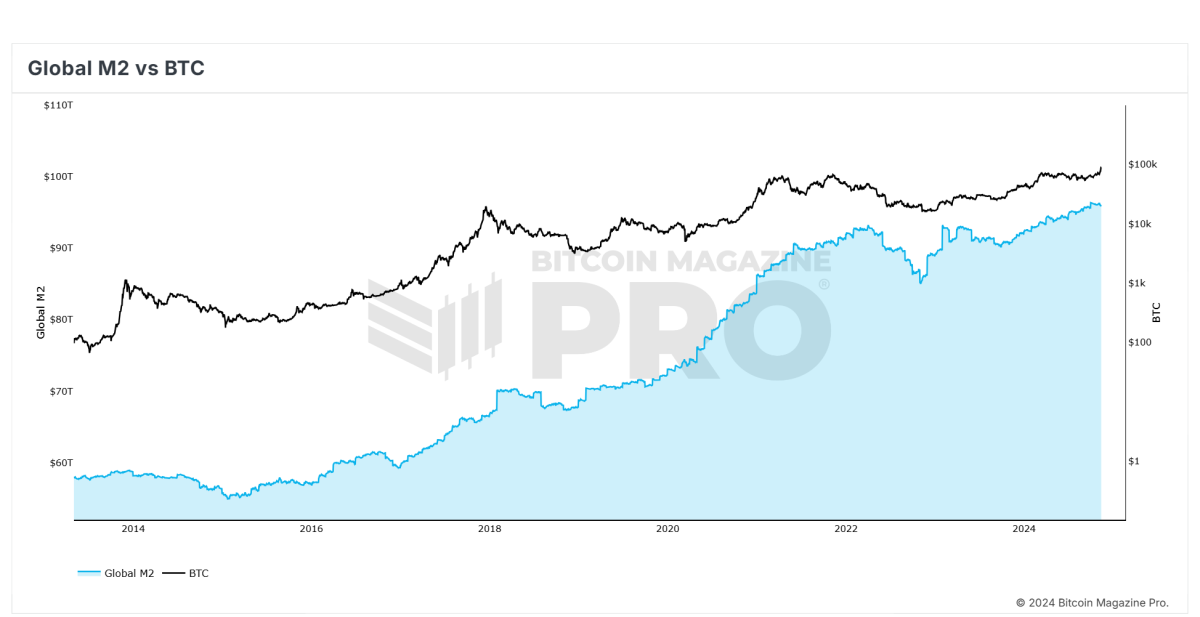

- International Liquidity: Bitcoin’s value typically strikes with international liquidity cycles, making macroeconomic consciousness essential.

- Institutional Adoption: Actions by main gamers similar to sovereign wealth funds, company treasuries, or institutional asset managers can vastly affect Bitcoin’s value.

- Regulatory Modifications: Authorities choices to control or undertake Bitcoin can considerably have an effect on its valuation.

Incorporating each macroeconomic elements and Bitcoin-specific metrics is essential for a well-rounded evaluation.

Closing Ideas: Keep Pragmatic

Crosby concludes by reminding buyers that no single mannequin can predict Bitcoin’s value with certainty. As an alternative, these instruments ought to be used to supply construction and perception into an unpredictable asset.

Sensible Ideas for Traders:

- Use A number of Fashions: Cross-check predictions utilizing completely different fashions to realize a clearer understanding of the market.

- Embrace Actual-Time Information: Depend on metrics like MVRV Z-score and SOPR for well timed, actionable insights.

- Adapt to Change: Be prepared to regulate methods primarily based on each inside knowledge and exterior influences.

Bitcoin Magazine Pro affords superior analytics and real-time knowledge to assist buyers navigate this fast-paced market. To dive deeper into Crosby’s insights, watch the total video right here: Truth About Bitcoin Stock To Flow, Power Law & Price Models.